Chart Patterns Cheat Sheet for Traders

By understanding chart patterns, traders can make more informed decisions, often leading to successful trades. Discover the key principles to unlocking market trends with our chart pattern cheat sheet for traders.

This guide simplifies market data, breaking down support and resistance levels, basic chart patterns, and more.

Learn to spot bearish and bullish chart patterns, understand chart trading patterns, and use the strength index to identify bullish trends. Get ready to enhance your trading strategy with this essential cheat sheet.

What Is a Chart Pattern in Trading?

At its core, a chart pattern is a series of price movements that are visually identifiable on a chart. These patterns are formed by the fluctuations in price of stocks, currencies, or commodities over time.

Technical analysts study these patterns to predict future market behavior. The premise behind chart patterns is rooted in the idea that history tends to repeat itself. Therefore, by recognizing these patterns as they form, traders can anticipate what is likely to happen next in the market.

3 Major Chart Pattern Types

Understanding the different types of chart patterns is crucial for applying this knowledge to trading strategies. Broadly, chart patterns fall into three categories: bilateral, continuation, and reversal.

Bilateral Chart Patterns

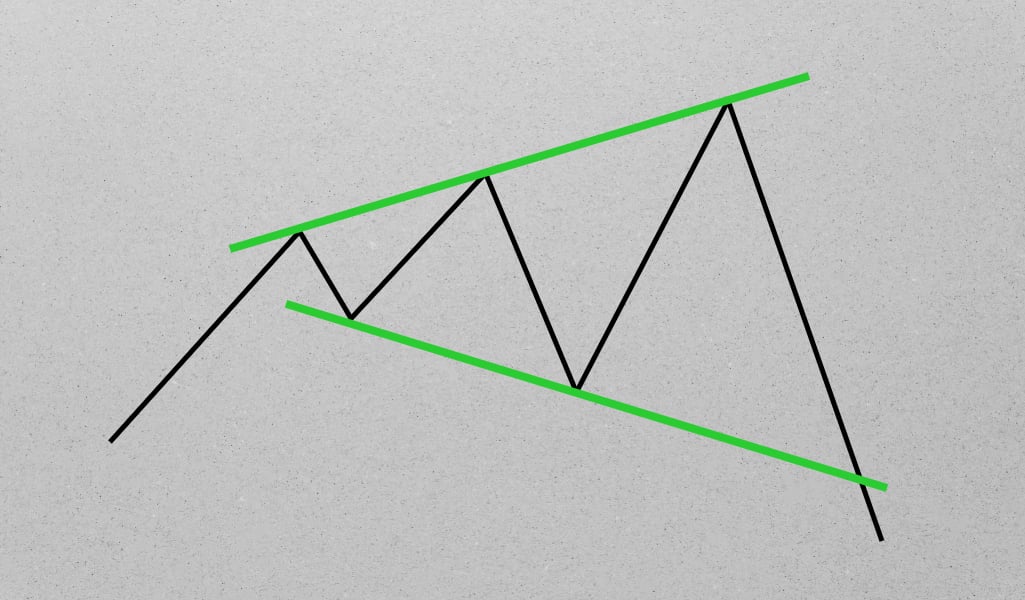

Bilateral chart patterns are the cryptic messages of the trading world. They signal that the market could move in either direction, presenting a conundrum that requires traders to be prepared for multiple outcomes. Examples include symmetrical triangles and flags, where the convergence of trend lines doesn’t suggest a clear future direction.

Continuation Chart Patterns

Continuation patterns are like pauses in a conversation, where the market catches its breath before continuing in the original direction.

These patterns are vital for traders looking to ride the wave of a trend. Patterns such as flags, pennants, and rectangles serve as indicators that the current trend is likely to persist, offering traders opportunities to join the trend with a higher probability of success.

Reversal Chart Patterns

Reversal patterns are the market’s way of saying, “I’ve changed my mind.” These patterns indicate a potential shift in market direction, offering traders early signals to exit or reverse their positions. The head and shoulders, double tops and bottoms, and cup and handle patterns are classic examples that signal a change in the prevailing trend.

Chart Pattern Cheat Sheet For Traders

Here are some of the most commonly used chart patterns:

Head and Shoulders (and Inverse Head and Shoulders)

This pattern is indicative of a reversal. The standard Head and Shoulders pattern signals a potential bearish turn after an uptrend, while the Inverse Head and Shoulders suggests a bullish reversal following a downtrend.

Double Top and Double Bottom

These patterns signal shifts in momentum. A Double Top occurs after an uptrend and indicates a potential reversal to the downside. Conversely, a Double Bottom forms after a downtrend and signals a possible upward reversal.

Triangles (Ascending, Descending, and Symmetrical)

Triangle patterns are continuation patterns observed in trends. An Ascending Triangle is typically bullish and forms during an uptrend, a Descending Triangle is generally bearish and appears during a downtrend, and a Symmetrical Triangle can break out in either direction, indicating consolidation.

Flags and Pennants

Both are short-term continuation patterns that signify a brief consolidation before the previous trend resumes. Flags appear as small rectangles usually sloping against the prior trend, while Pennants are small symmetrical triangles that form right after a sharp movement.

Cup and Handle

This pattern resembles a tea cup with a handle, indicating a bullish continuation. The cup represents a rounding bottom, and the handle is formed by a short pullback followed by a breakout above the handle’s resistance.

Wedges (Rising and Falling)

Wedges signal reversals or continuations depending on the trend context and the wedge type. A Rising Wedge in an uptrend is typically bearish, while in a downtrend, it can indicate a bullish reversal. A Falling Wedge generally suggests a bullish reversal in an uptrend and a continuation in a downtrend.

Rectangle (Trading Range)

Represents a consolidation phase where the price moves between a well-defined area of support and resistance before eventually breaking out. The direction of the breakout can indicate the continuation of the prior trend or a reversal.

Chartist Patterns As a Combination of Supports and Resistances

In the context of graphical analysis, we also talk about chart figures representing combinations of supports and resistances. These figures fall into two main categories:

- Reversal figures;

- Continuation figures.

Reversal patterns then indicate that there is a change in trend represented by specific patterns, such as the double bottom, double top, or ETE (shoulder-head-shoulders).

As for continuation figures, as their name indicates, these announce the continuity of an ongoing trend represented by specific figures, such as the flag, the pennant or the cup with handle.

Continuation Chart Patterns

Continuation chart patterns announce the continuation of the current trend. The exit from the figure is then done in the direction of the movement preceding the formation of the figure. In an uptrend, the figure indicates a continuation of the upward movement, and the opposite occurs in a downtrend: a continuation of the downward movement.

Continuation figures offer the possibility for the asset to consolidate the current trend movement without calling it into question.

It is very common to find these continuation chart patterns on price charts. These make it possible to distinguish entry points to take advantage of the trend, but you will have to be careful.

Whatever the extent of the consolidation within the figures, it is essential to wait for a signal of resumption of the trend before taking a position.

This signal can take the form of a reversal following a point of contact with one of the lines of the figure or even an exit from the continuation figure in the direction of the trend.

Some of the most popular continuation chart patterns, other than those mentioned previously, are the bullish/bearish channel, the ascending/descending triangle, and the symmetrical peak/trough triangle.

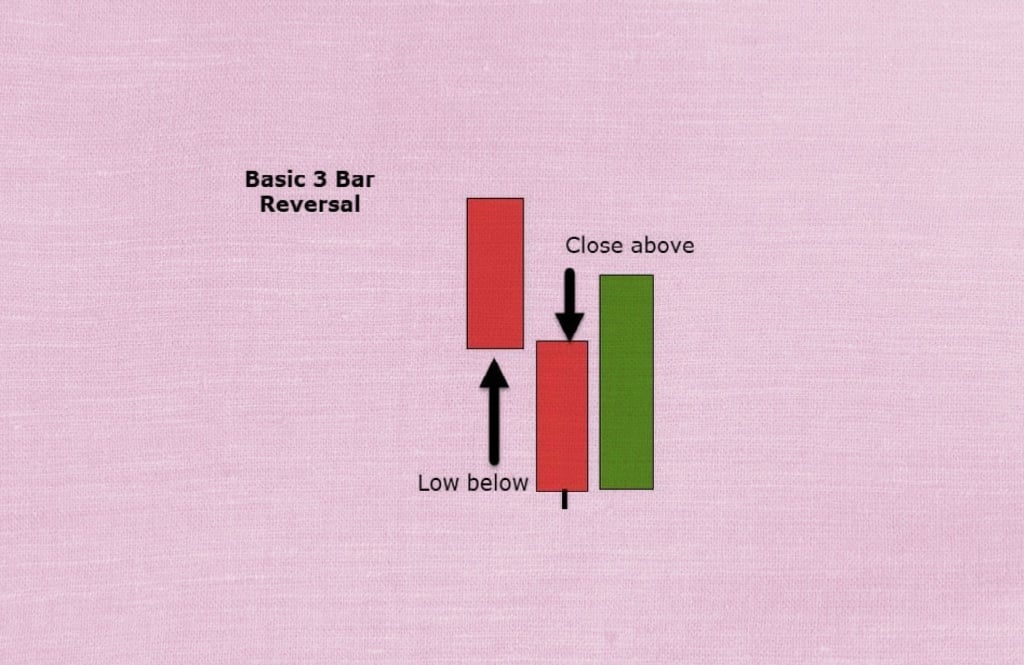

Reversal chart patterns

Just like the continuation chart patterns we saw previously, the reversal chart patterns indicate a reversal of the current trend.

The exit from a reversal figure is done in the opposite direction to the movement which preceded the formation on the chartist figure.

In a bearish trend, a reversal chart pattern thus announces an upward movement and it is the opposite which occurs within the framework of an upward trend: figure announcing a bearish movement.

In graphical analysis, one should not anticipate the output of the figure. Indeed, a chartist reversal pattern is only validated when the price exits the pattern.

We talk about a breakout of the neckline or the bullish/bearish oblique. For example, on a chart, we may see a double bottom appear, but this pattern can quickly transform into a triple bottom or a range. It is therefore important to wait for the buy or sell signal.

Reversal patterns are very relevant with ETEs and ETEi (inverted shoulder-head-shoulder) at the top of the list as well as the wedge.

These offer excellent probabilities of successful trades. Each chartist reversal figure then has a theoretical objective of the course and the latter is not always achieved.

It is therefore essential to follow the movement with a close stop at the exit of the figure. It should be remembered that this type of figure gives a counter-trend signal.

However, the most relevant figures are generally the figures which go in the direction of the medium/long term trend of the asset. A reversal pattern can be counter-trend in the short term, but only in the direction of the underlying trend.

In the case where the type of pattern occurs in the direction of the trend, the pattern is then invalidated and we have a continuation signal.

The use of bearish and bullish signals in graphical analysis in trading

In graphical analysis, there is on the one hand the identification of supports and resistances and on the other the analysis of the behavior of prices as they approach and then contact these levels.

The method usually used by traders is simple and based on visual graphical analysis. This consists of buying when prices come into contact with support and then selling when they come into contact with resistance.

On the other hand, in the context of a VAD (short sale), the method will then be reversed to the extent that we will start by selling short in contact with resistance to buy back the position in contact with support.

Traders, with much more experience, use another approach which is more or less complex.

This consists of waiting for a resistance to be crossed to buy and then hoping to benefit from a continuation of the upward price trend until the next resistance.

Likewise, during the breakdown of a support, they will sell short in order to hope to benefit from a continued decline in prices until the next support.

Can Chart Patterns Cheat Sheets Replace Technical Analysis?

While chart patterns cheat sheets are incredibly useful, they are but one tool in the broader toolbox of technical analysis.

They provide a foundation for understanding market movements but cannot replace the depth and breadth of insights gained from comprehensive technical analysis.

Successful traders often combine chart pattern recognition with other technical indicators and fundamental analysis to make well-rounded trading decisions.

Conclusion

The use of chart patterns and cheat sheets can significantly enhance a trader’s ability to make informed decisions. By understanding and recognizing these patterns, traders equip themselves with the knowledge to predict market movements more accurately.

However, it’s important to remember that no single tool guarantees success. The most successful traders use a combination of chart patterns, technical analysis, and fundamental analysis to guide their decisions. As you embark on or continue your trading journey, let chart patterns be your guide, but not your sole advisor.

Chart Patterns Cheat Sheet FAQ

Are chart patterns reliable?

Chart patterns are reliable indicators of potential market movements, but they are not infallible. Their effectiveness increases when used in conjunction with other analysis methods.

Why do you need a chart pattern cheat sheet?

A chart pattern cheat sheet streamlines the process of pattern recognition, enabling quick and informed trading decisions, especially useful in fast-paced trading environments.

What is the most profitable chart pattern?

Profitability can vary, but patterns like the head and shoulders, cup and handle, and bullish or bearish flags are renowned for their predictive value and potential profitability.

Which chart to trade?

For trading, Japanese candlestick charts are widely used. They provide a visual view of price fluctuations, showing opens, closes, highs and lows over a given time period.

These charts help identify price trends and patterns important for decision making. Traders can also use bar or line charts, but Japanese candlesticks are particularly popular for their wealth of information.

Which site to use for graphic analysis?

To perform graphical analyses, several platforms are available. Sites like TradingView, ProRealTime and MetaTrader offer advanced chart analysis tools. These platforms allow traders to view interactive charts, apply technical indicators and perform in-depth analysis. Choose a platform that meets your needs and offers customization features for accurate chart analysis.

The post Chart Patterns Cheat Sheet for Traders appeared first on FinanceBrokerage.