Centrica Share Prices Dip Amid Profit Decline and Dividend Concerns

Centrica share price (LSE: CNA) declined on Thursday, Aug 1, following the release of its half-year results. The company reported a sharp drop in profits, especially in its retail sector, marking the end of a period of strong earnings.

So, how far did Centrica slide from its initial intrinsic value? To find out, we’ll examine the latest financial data to determine if the current stock price on London Stock Exchange is fair. We’ll project its future cash flows and bring them back to their present value using the Discounted Cash Flow (DCF) model. While the concept might seem a bit technical, the process is actually quite accessible and straightforward.

While yield is a key consideration, assessing the sustainability of a company’s dividend payments is also crucial. Centrica’s earnings comfortably cover its dividend, allowing the company to reinvest a significant portion of its profits back into the business.

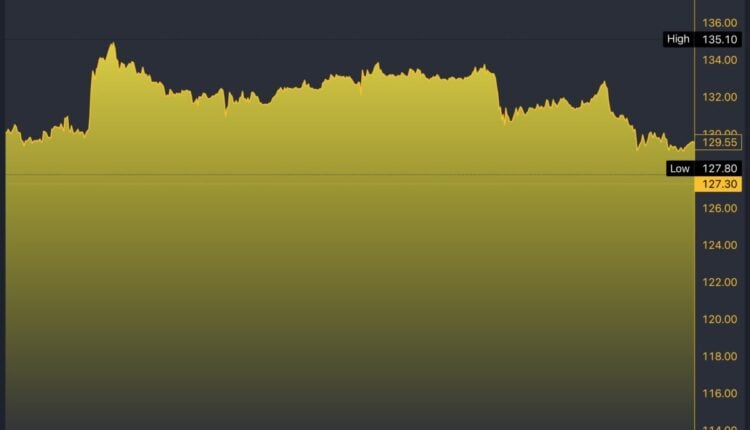

CNA/GBX 5-Day Chart

Centrica Share Price News: Dissecting the Variables

Presently, the Centrica share price forecast indicates a 35.3% decline in earnings per share over the coming year. If the dividend stays on its current path, the payout ratio could reach 25%, which should be manageable for the company.

The company boasts a long history of dividend payments, yet its track record reveals notable challenges. Since 2014, the annual dividend has sharply declined from £0.167 to £0.04, representing a substantial reduction of 76%.

A trend of decreasing dividends often signals potential problems. It can erode shareholder returns and indicate underlying issues within the company.

The company’s track record of inconsistent and diminishing dividends may create a deceptive atmosphere. Thus, assessing earnings per share (EPS) growth becomes paramount.

Despite this questionable background, the Centrica share price chart has recently showcased a remarkable performance. For example, its EPS have been surging at an annual rate of 59% over the past five years. This robust EPS growth, combined with a modest payout ratio, creates an ideal scenario for dividend stocks, suggesting that the company is well-positioned to increase its dividend payments in the future.

£132.65 Opening Amid Volatility and Growth Potential

Centrica PLC’s share price today opened at £132.65, marking a slight increase from the previous close of £130.45 on August 1, 2024. The trading volume reached 19,625,393 shares, generating a turnover of £16,875,693. With the 52-week range spanning from £123.35 to £173.70, the current Centrica share price today is nearer the lower end of this spectrum. This positioning could either present a potential investment opportunity or reflect recent market adjustments.

Overall, Centrica has demonstrated a commendable growth rate of 59% annually over the last five years. With EPS increasing steadily and a low payout ratio, Centrica appears well-positioned to potentially enhance its dividend in the future.

The company produces significant cash flow, and its earnings robustly sustain dividend payouts. Nevertheless, projections suggest a potential decline in earnings over the coming year. That, on its own, could introduce some volatility if this trend continues. Despite this, Centrica appears to offer a promising dividend prospect.

Generally, investors seem to favor firms with consistent dividend policies over those with erratic distributions. Nonetheless, a comprehensive stock analysis should also account for other performance-influencing factors.

The post Centrica Share Price Falls After Profit Drop appeared first on FinanceBrokerage.