APM Stock: Is It Worth Investing in APM?

Aptorum Group Limited is a clinical-stage biopharmaceutical company based in the United Kingdom, dedicated to the exploration, development, and commercialization of therapeutic assets for the treatment of diseases with unmet medical needs.

Is it a good idea to invest in APM Stock? Let’s find out!

In order to answer the question mentioned above, it is necessary to gather more information about the Aptorum Group.

Their primary focus lies in oncology and infectious diseases. The company’s business segments include Therapeutics and Non-Therapeutics.

The Therapeutics segment is actively engaged in researching and developing various drug molecules and advanced technologies to address a wide range of human disease conditions.

Notably, Aptorum Group is advancing two prominent projects, ALS-4 and SACT-1, with a focus on combating infectious diseases and cancer, including orphan oncology indications.

On the other hand, the Non-Therapeutics segment encompasses three distinct businesses.

The Non-Therapeutics segment comprises three distinct enterprises: diagnostics projects, which feature the innovative PathsDx Test; natural supplements, including the NativusWell product line; and an AML Clinic.

The PathsDx Test is a pioneering molecular-based technology designed for the swift identification and detection of pathogens, and it is currently being developed in collaboration with A*STAR.

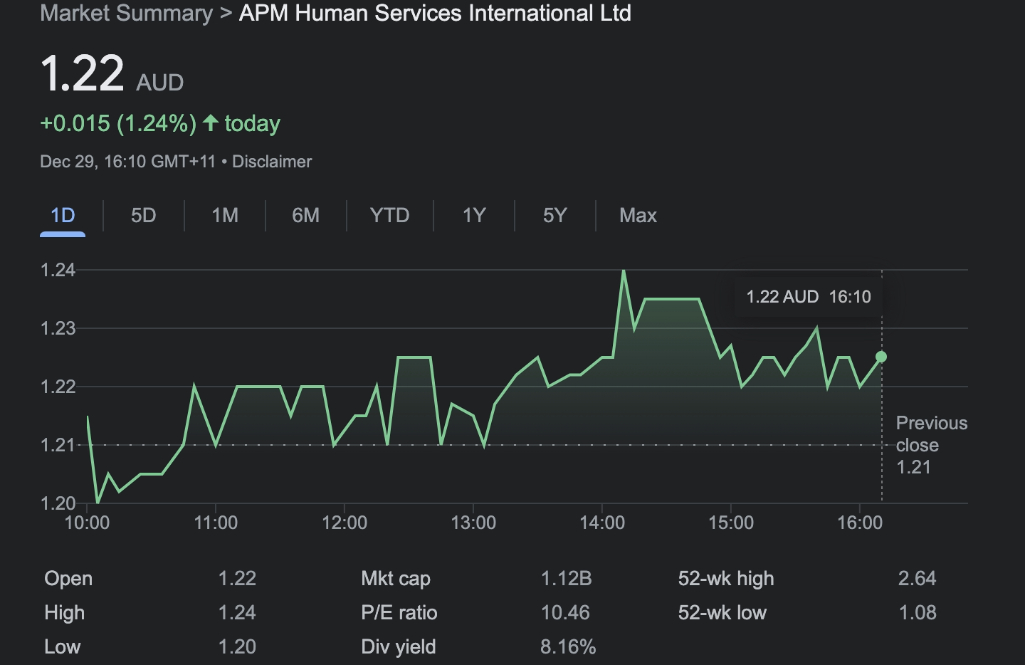

APM stock forecast

Let’s return to APM stock. When we analyze the anticipated performance of APM stock for the year 2024, we find a promising ceiling value of $2.86. This suggests a bullish trend, with a significant upside potential of 51.96%, indicating profitable prospects.

The average monthly return is estimated at 3.71%, making it an attractive proposition for investors seeking to enhance their portfolios.

On the other hand, there is a potential downside, with the APM stock possibly falling to a floor value of $1.81 in 2024. This implies a potential decline of 3.75%, emphasizing the need for cautious investment strategies and vigilant monitoring.

In the broader context, it appears that APM stock is likely to move within a price range, with a resistance level at $2.86 and a support level at $1.81. This price fluctuation range of $1.04 offers nuanced opportunities for entry and exit points, pivotal for strategic stock trading.

How to deal with challenges

Overcoming challenges associated with the stock market is essential for investors to achieve long-term success and financial growth. The stock market can be unpredictable and volatile, presenting various obstacles that investors must navigate. Here are some strategies and tips for overcoming these challenges:

Education and research: One of the fundamental ways to overcome stock market challenges is through education and research. Investors should continuously educate themselves about the stock market, various investment strategies, and the companies they invest in. Understanding the fundamentals and staying informed about market trends can help make informed decisions.

Diversification: Diversifying your investment portfolio is a proven strategy to mitigate risk. By spreading your investments across different asset classes, sectors, and industries, you can reduce the impact of poor-performing stocks or economic downturns. Diversification can help maintain a balance between risk and reward.

Long-term perspective: The stock market is subject to short-term fluctuations and volatility. To overcome this challenge, adopt a long-term perspective. Successful investors focus on the long-term growth potential of their investments rather than reacting to short-term market movements. Patience can be a valuable asset in stock market investing.

Risk management

Managing risk is crucial in the stock market. Set clear risk tolerance levels and stick to them. This might involve using stop-loss orders, setting investment limits, or using portfolio risk management tools. Avoid investing more than you can afford to lose.

Regular monitoring and review: Keep a close eye on your investments and regularly review your portfolio. This allows you to make necessary adjustments, reallocate assets, and rebalance your portfolio as needed. Avoid a “set it and forget it” mentality.

Professional guidance: Consider seeking the assistance of a financial advisor or investment professional. They can provide expert guidance, help you create a personalized investment strategy, and offer valuable insights to navigate the complexities of the stock market.

Avoid herd mentality: Following the crowd or investing based on popular trends can lead to poor investment decisions. Avoid herd mentality and make independent judgments based on your research and investment goals.

Emergency fund: Maintaining an emergency fund outside of your investment portfolio is important. It provides a safety net for unexpected financial challenges, reducing the need to liquidate investments during market downturns.

Continuous learning: The stock market is dynamic and constantly evolving. Stay updated on market developments, new investment opportunities, and changing regulations. Continuous learning and adaptability are essential to staying ahead.

In summary, Aptorum Group Limited is a UK-based biopharmaceutical company dedicated to advancing therapeutics for diseases with unmet medical needs, primarily focusing on oncology and infectious diseases.

It is important to make a decision regarding APM stock based on various factors. Importantly, it is recommended to monitor the information about Aptorum Group to minimize risk factors.

The post APM Stock: Is It Worth Investing in APM? appeared first on FinanceBrokerage.