Mastering M Pattern Trading: Strategies and Insights

In the realm of technical trading, chart patterns play a crucial role in decision-making. Among these patterns, W and M trading pattern, also known as the Double Top, stands out as a significant indicator of potential trend reversals. This article delves into understanding M pattern trading, its implications, and strategies for effective trading.

Key takeaways

- The M pattern, or double top, is a bearish reversal chart pattern in technical trading, indicating a shift from an uptrend to a downtrend.

- You can spot the M pattern by finding two peaks forming an ‘M’ shape at a similar price level, with the area between the peaks acting as support.

- To confirm the M pattern, wait for the price to break below the support level between the peaks. This break signifies a bearish reversal.

- Assess the risk-reward ratio to ensure the potential reward justifies the risk taken in the trade.

- Analyze the M pattern across different time frames for a comprehensive market view.

- Recognize the W shape or double bottom as a bullish reversal counterpart to the M pattern for effective reversal trading.

What is M Pattern in Trading?

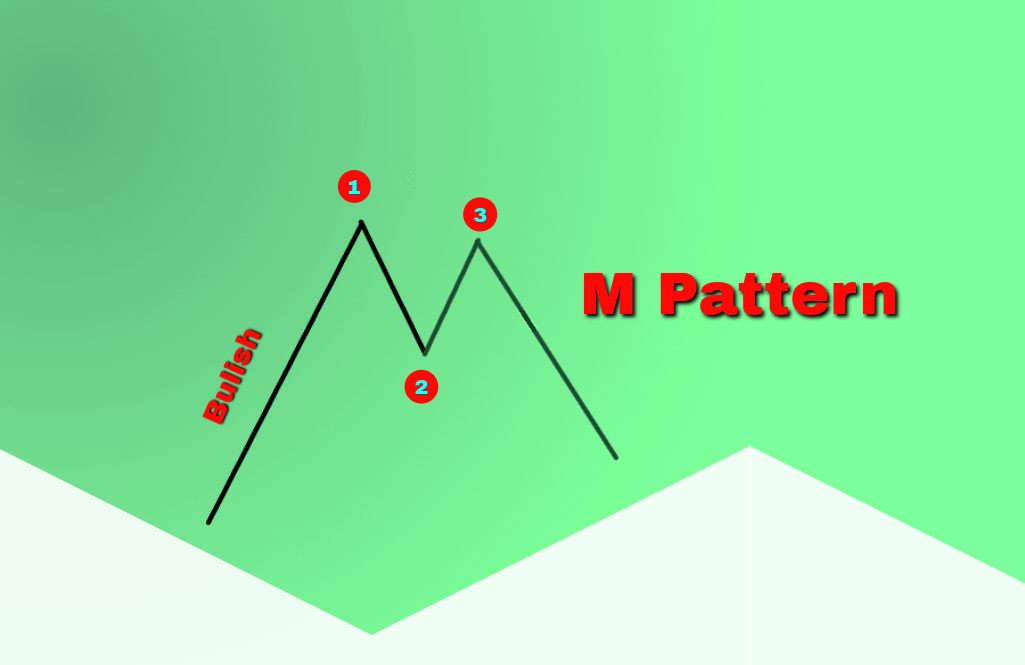

The M pattern in trading, commonly referred to as the double top chart pattern, is a bearish reversal pattern seen in stock, commodity, and forex charts. The pattern resembles the letter ‘M’ and indicates a shift from an uptrend to a downtrend. It consists of two consecutive peaks at approximately the same price level, separated by a moderate trough. This formation signals that the bullish momentum is waning, and a bearish phase is imminent.

Identifying Double Tops in the Market

Spotting a double top begins with identifying two peaks that form an ‘M’ shape. These peaks should be at a similar price level, representing a resistance level where the price struggles to break through. The area between the peaks acts as a support level. A complete M pattern forms when the price action breaks below this support level, confirming a bearish reversal.

Strategies for Trading the M Pattern

Before making any trading decisions, confirm the M pattern formation. Wait for the price to break below the support level between the two peaks. This break confirms the bearish reversal trend.

Place stop loss orders just above the previous high or the second peak of the M pattern. This strategy helps manage risk if the price action reverses and invalidates the pattern.

Assess the risk-reward ratio before entering a trade. A good practice is to aim for a risk-reward ratio where the potential reward justifies the risk taken.

Analyze multiple time frames to get a comprehensive view of the market trends. M patterns can form on short-term charts like hourly or daily, as well as on long-term charts like weekly or monthly.

Confirm the M pattern with volume analysis. Typically, volume should decrease on the formation of the second peak and increase as the price breaks below the support level.

Trading Indicators

Besides the basic formation of the M pattern, traders often use additional trading indicators for better accuracy:

Trend Line: Draw a trend line connecting the lows of the M pattern. A break below this line further confirms the bearish reversal.

Technical Analysis Tools: Use tools like Moving Average Convergence Divergence (MACD) or Relative Strength Index (RSI) to gauge the strength of the trend and validate the reversal signal.

Reversal Trading with Double Bottoms: Just as the M pattern signals a bearish reversal, its counterpart, the W shape or double bottom, indicates a bullish reversal. Understanding both patterns can enhance reversal trading strategies.

The Limitations and Challenges

Despite being a powerful tool, M pattern trading comes with its limitations. Misinterpretation of the pattern can lead to false readings and incorrect trading decisions. It requires patient analysis and a critical assessment of the support level. The key is to wait for confirmation of the pattern before executing any trades.

Long Positions and Rising Security Price

For those holding long positions, the formation of an M pattern serves as a signal to consider selling the stock or at least tightening stop losses to protect profits. As the security price starts reversing from the second peak, it’s crucial to reassess the bullish rally’s sustainability.

Conclusion

Mastering the M pattern in trading requires understanding its structure, implications, and the right strategies to capitalize on the bearish reversal signals it provides. Remember, success in M pattern lies in the ability to accurately identify the pattern, make calculated decisions, and manage risks effectively.

The post Mastering M Pattern Trading: Strategies and Insights appeared first on FinanceBrokerage.