The stock market seems to be pulling back after last week’s strong rally. It’s a healthy sign, given the incredible performance in November. Jeff Hirsch, editor of the Stock Trader’s Almanac, said that price action in early December tends to be flat.

This week, we’ll get the November nonfarm payrolls and the JOLTs report. The labor market is still strong, and we’re likely to see that when the data is reported. The market is expecting 175,000 new jobs, which is a strong number. And unemployment is expected to remain at 3.9%. If the data is much stronger than expected, will there be a selloff?

We need to see signs of inflation cooling before the Fed starts cutting interest rates. Although the Fed says they want inflation to be at 2%, we’re far from that level. But the stock market has priced in four interest rate cuts in 2024, which is the main reason behind November’s stellar rally.

The Bitcoin Rally

Bitcoin has benefited from the narrative. The cryptocurrency hit a 52-week high, closing above 42,000 (see the daily chart of Bitcoin to US dollar below).

CHART 1: DAILY CHART OF BITCOIN TO US DOLLAR. $BTCUSD broke out from its July highs in late October. Since then it’s been going higher and higher.Chart source: StockCharts.com. For educational purposes.

In late October, $BTCUSD broke above its July highs, which was considered an important resistance level. Since breaking above this level, the cryptocurrency has soared. Where to next for Bitcoin? Looking at the weekly chart below, the next level to break above would be the March 2022 high.

CHART 2: WEEKLY CHART OF BITCOIN. When the MACD line crosses over the signal line close to the zero line, it’s often a very bullish indication. Look at what happened in October 2020. Chart source: StockCharts.com. For educational purposes.The MACD line has crossed above its signal line, and it happened close to the zero line, which is considered a bullish indication. Look at what happened when a similar situation occurred in October 2020.

On the daily chart, the MACD crossover of the signal line indicates further upside potential, but not as much as the weekly chart suggests. Since $BTCUSD is a volatile asset, you want to watch the daily chart for entry decisions, and perhaps an even smaller time frame to make your exit decisions.

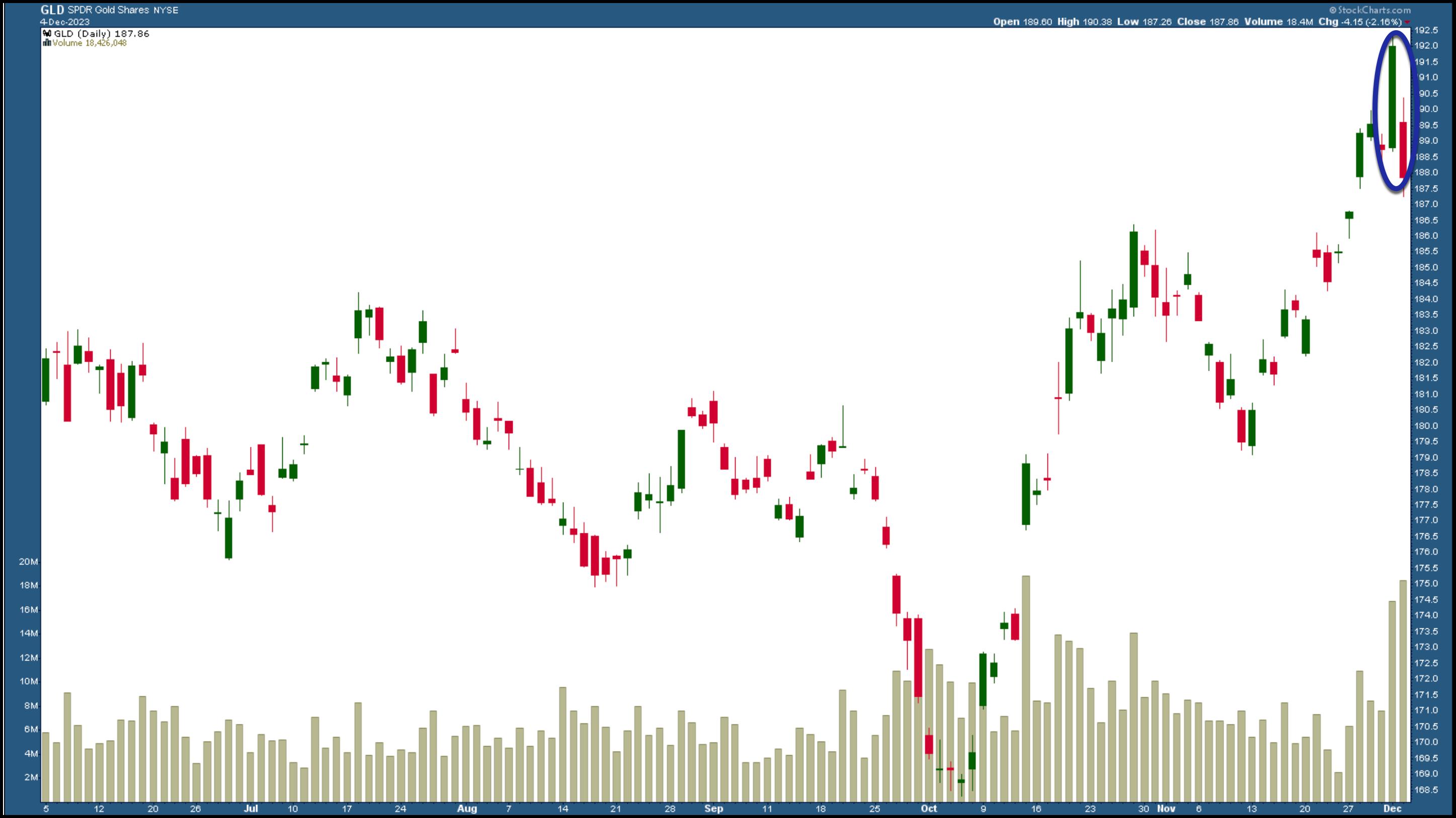

Gold prices also displayed interesting price action. The shiny metal hit a record high of $2152 per ounce but then retreated sharply, which was interesting given there hasn’t been a drastic reversal in interest rate trends. But realistically, it makes sense. When gold hits a high, why not take profits and earn some interest on the cash? So, it may be a short-term move. It’s worth watching gold, since investors use it to diversify their portfolio holdings and as a hedge.

The SPDR Gold Shares ETF (GLD) is popular among retail investors. It follows gold prices relatively well (see chart below).

CHART 3: GOLD HITS A NEW HIGH, BUT SELLS OFF. Investors sold off their gold assets in a rush after price hit an all-time high.Chart source: StockCharts.com. For educational purposes.

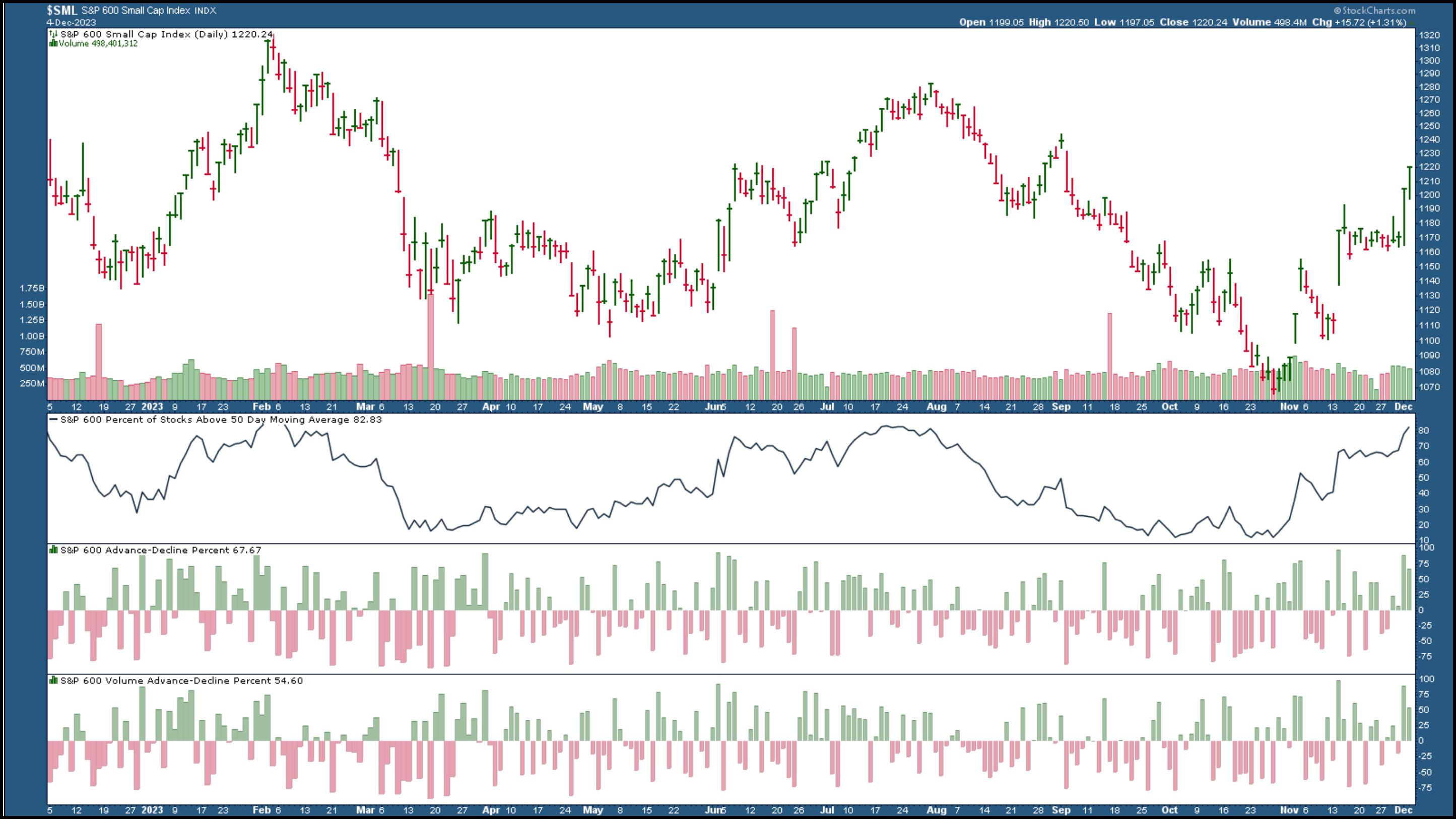

Don’t Forget the Small Caps

One asset class that closed higher today is small caps. This group is showing strength after getting trampled. The market internals continue to support the trend higher, which is encouraging, especially after Hirsch reiterated that small-caps tend to perform well starting in mid-December. Are they getting a head start on the rally, or can we expect a big rally in the middle of the month? It’s something to watch.

CHART 4: SMALL CAP STOCKS GAIN STRENGTH. After being trampled, small-cap stocks are starting to rally and trend higher.Chart source: StockCharts.com. For educational purposes.

The Bottom Line

Early December should be an interesting time in the stock market. Keep an eye on the typical seasonal patterns at this time of the year, especially in a pre-election market. How December and early January play out will indicate how the market will perform in 2024.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.