Note to the reader: Over the next couple of weeks and months, I will be republishing the contents of my book, “Investing with the Trend,” in article form here on my blog. I’m calling this series “The Hoax of Modern Finance” for reasons you will learn below. Hopefully, you will find this content useful. As always, let me know what you think in the comments area below the article. – Greg Morris, Nov. 2023

CHAPTER 1: Introduction

I have learned a few things over the years and probably retained even fewer. For example, I know that when dealing with the unknown, such as it is with the analysis of the stock market, you absolutely cannot speak in absolutes. I also know that random guessing about what to do in the market is a quick path to failure. One needs a process for investing. Any process is better than no process or, even worse, a random or constantly changing process. Hopefully, with this book, you will find the path to a successful process.

The noblest pleasure is the joy of understanding. — Leonardo da Vinci

How can you even begin to analyze the market if you are not using the correct tools to determine its present state? If you do not fully grasp the present state of the market, your analysis, whether real or anticipated, will be off by an amount equivalent to at least the error of your current analysis. And your error will be compounded based on the timeframe of that analysis. This highlights why most forecasts are a waste of time.

Believable Misinformation

One should remember things are quite often not what they seem. It is absolutely amazing to me how many things people believe that are not true (speaking with the voice of experience here). Below are some things that many of us learned in our formative years from our teachers and parents, most of which we just accepted as fact because we heard it from people we believed.

Myth: Water runs out of a bathtub faster as it gets toward the end.

Fact: Assuming the tub’s sides are cylindrical, the pressure is constant; it only appears to drain faster because you can observe it starting to swirl toward the end, something you could not observe when the tub was full. The swirling action deceives one into thinking it is draining faster.

Myth: George Washington cut down a cherry tree.

Fact: George Washington did not cut down a cherry tree. That was a story told so that adults could teach their children that it was bad to tell lies—not even our founding fathers told lies. Parson Mason Locke Weems, the author who wrote about it shortly after Washington’s death, was trying to humanize Washington.

Myth: Washington threw a silver dollar across the Potomac River.

Fact: The Potomac River is almost a mile wide at Mount Vernon, and silver dollars did not exist at that time.

Myth: The Battle of Bunker Hill was fought at Bunker Hill.

Fact: It was fought at Breed’s Hill in Charleston, Massachusetts.

Myth: Dogs sweat through their tongues.

Fact: Guess what? Dogs don’t sweat. Their tongues have large salivary glands that keep them wet.

Okay, the following two examples of believable misinformation are only for the hardy who have found this section interesting. The rest should skip them. They are only for nerds like me.

Myth: December 21 in the northern hemisphere is the shortest day of the year.

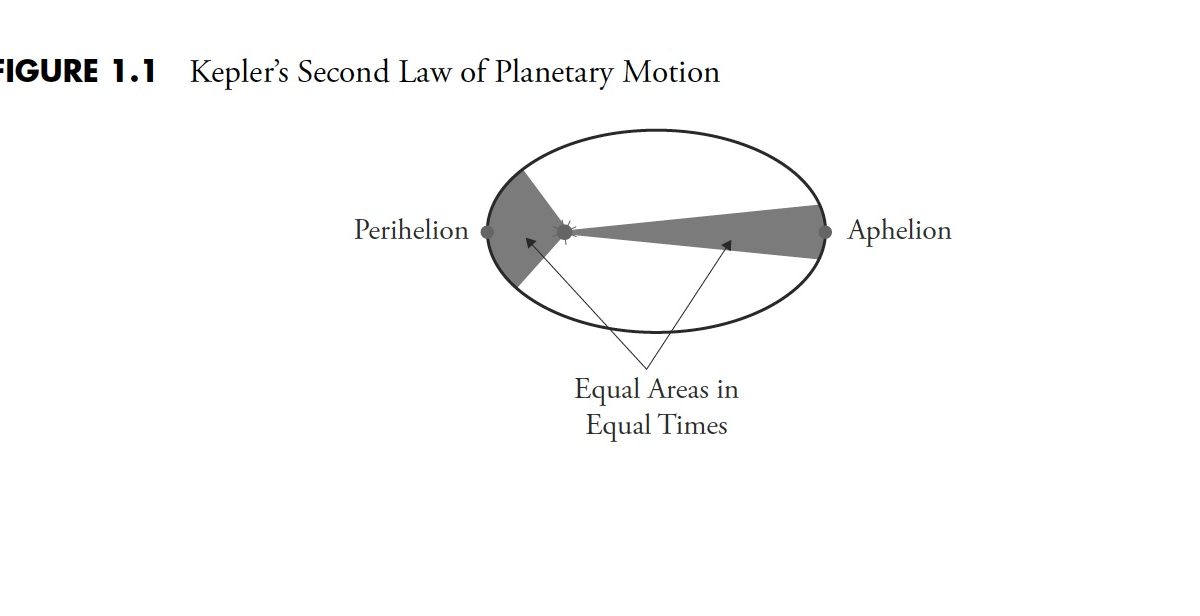

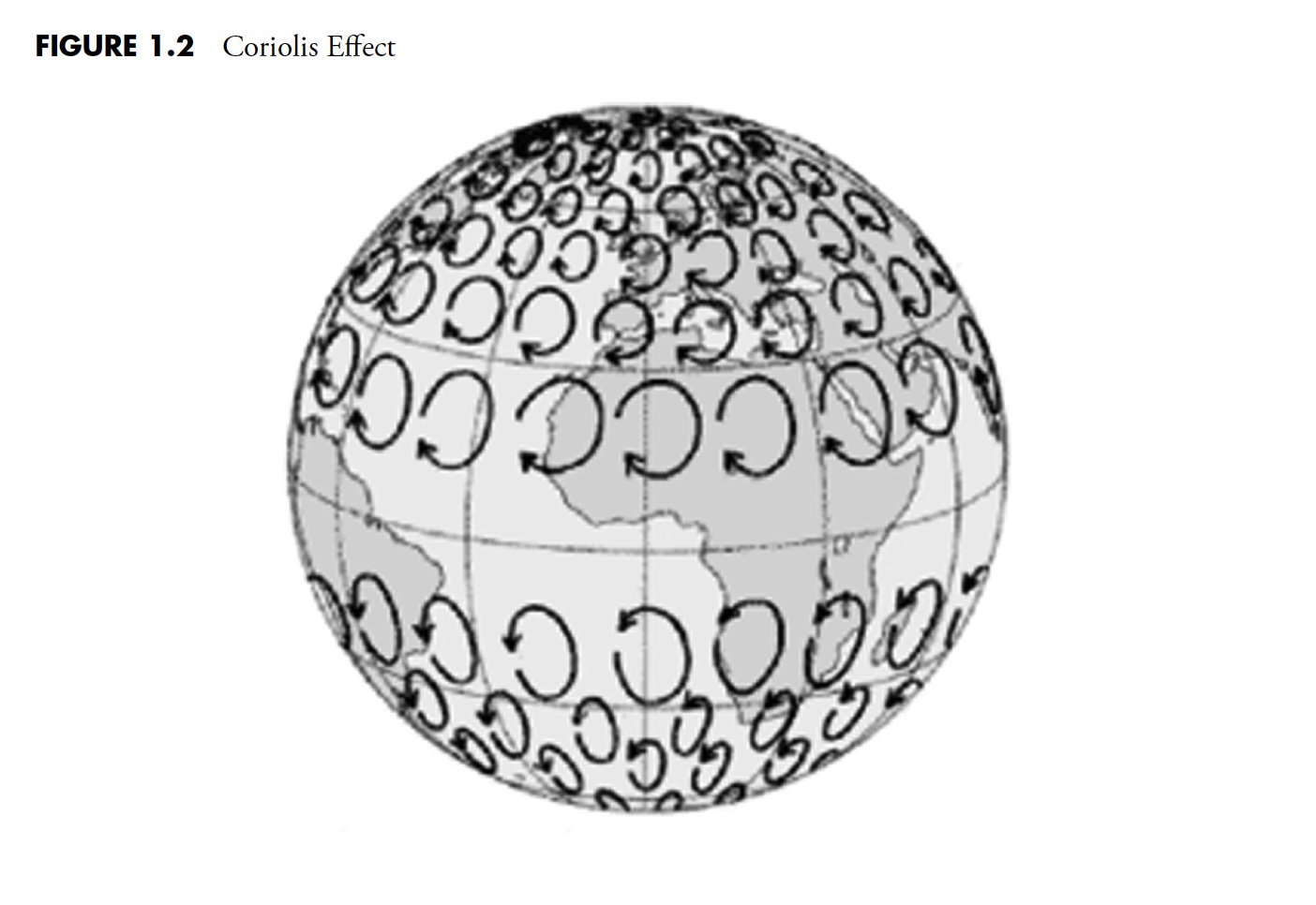

Fact: Most people probably believe this. However, it is actually the longest astronomical day based on Kepler’s Second Law of Planetary Motion (planets, in their elliptical orbits, sweep out equal areas in equal time). When the Earth is closest to the sun, the northern hemisphere is tilted away, and a much greater arc is swept in a day’s travel than when the Earth is the furthest distance from the sun. If the question were posed as “What is the day with the shortest period of daylight?” then it would be correct.

See Figure 1.1 for an illustration of Kepler’s Second Law of Planetary Motion.

An additional observation on the tilt of the Earth is that summers in the southern hemisphere are generally warmer than the summers in the northern hemisphere. This can be influenced by the fact that there is significantly more ocean in the southern hemisphere, but also, the southern hemisphere is tilted more towards the sun when the sun is closest to the Earth.

Figure 1.1 Kepler’s Second Law of Planetary Motion

Figure 1.1 Kepler’s Second Law of Planetary Motion

Myth: Bath water drains counterclockwise in the northern hemisphere.

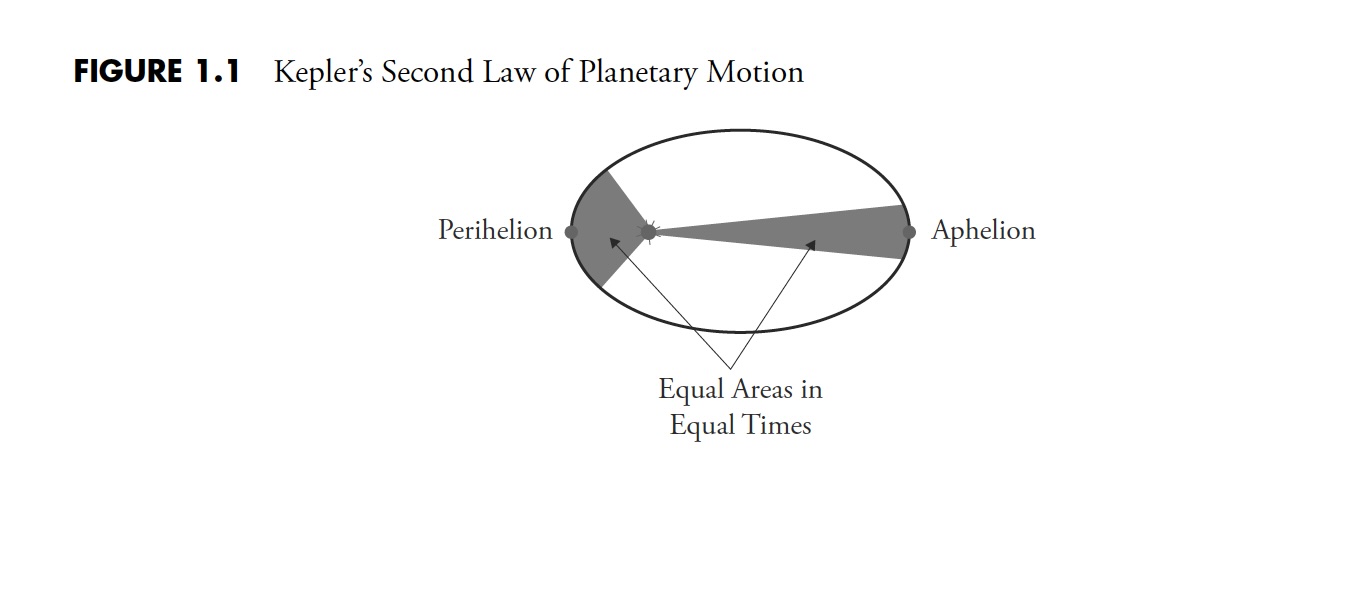

Fact: Another example of how people have believed things that are simply not true is that, in the northern hemisphere, many will say that water, when draining from a tub, will swirl counterclockwise. Although it very well may do so, it is not for the reason they think it will. This is an example of a little bit of scientific knowledge totally misapplied. The Coriolis Effect (see Figure 1.2) is caused by the earth’s rotation and generally applies to large, almost frictionless bodies, such as weather systems. This is why, in the northern hemisphere, hurricanes rotate counterclockwise, and in the southern hemisphere, they rotate clockwise. The rotational effect is measured in arc seconds (a unit of angular measure equal to 1/60 of an arc minute or 1/3600 of a degree), which is an extremely small measurement of angular rotation. Applying this principle to the rotation of water draining from a tub is totally incorrect. High-pressure and low-pressure weather patterns are also reversed—I would love to see a weather reporter from Dallas move to Santiago and adapt to that.

Hopefully, you are getting my point. In the past few years, the Internet has been the source and exploitation of much hype and false information. How many times have you received an e-mail from a friend (who probably did not originate it) and believed it to be true but did not bother to check it out and forwarded it anyhow? You should start verifying them because many of them are hoaxes. Believable misinformation flourishes.

Figure 1.2 Coriolis Effect

Figure 1.2 Coriolis Effect

If you enjoy this type of information, I would recommend a book by Samuel Arbesman, The Half-Life of Facts: Why Everything We Know Has an Expiration Date. Arbesman is an expert in scientometrics, which looks at how facts are made and remade in the modern world. People often cling to selected “facts” as a way to justify their beliefs about how things work. Arbesman notes, “We persist in only adding facts to our personal store of knowledge that jibe with what we already know, rather than assimilate new facts irrespective of how they fit into our views.” (B4). This is known as confirmation bias, which is dealt with in Chapter 6.

A general theme throughout this book is one of separating fact from fiction. Fiction, in this case, is often a well-accepted theory on finance, economics, or the market in general. If you were caught believing some of the things mentioned in the previous paragraphs, then how much from the world of investing do you believe? Just maybe you have accepted as fact some things that simply are not true. I certainly know that I did.

In this chapter, a lot of basic information is provided to assist you in understanding the remainder of this book. There are definitions, mathematical formulae, explanations of anomalies, historical events that affect the data, differing methods of calculation, and a host of other important information normally found in an appendix. It is of such importance to understand this material that it belongs prior to the discussion and not in the appendix, as is usually the custom.

Thanks for reading this far. I intend to publish one article in this series every week. Can’t wait? The book is for sale here. Next up: A helpful list of indicators and terminology that you need to know, followed by a frank discussion about financial data sources and their accuracy.