Bear Pennant: How to Trade the Bear Pennant Pattern

The bear pennant pattern is a chart formation that helps you spot downtrends. It’s a bearish chart pattern that is easy to identify. And it is very helpful regarding the identification of false bottoms. Also, it can alert you of deep and long corrections in the market.

In this article, we will show you what the bear pennant represents in chart analysis and how to identify it. We will show you how to trade this bearish pattern and what are its strengths and weaknesses. Also, we will see what indicators are necessary for its confirmation.

Key Takeaways

- The bear pennant chart pattern signals a continuation of a downtrend following a period of consolidation.

- Traders identify this pattern by spotting the initial downward move and the subsequent consolidation phase.

- The pattern completes when prices break below the lower trend line, suggesting a continuation of the downtrend.

- The pattern consists of two main elements: the flagpole, indicating a trend of lower lows and higher highs, and the pennant, showing price consolidation between converging lines.

- Bear pennants are useful for identifying current downtrends and offer clear trading levels.

What is Bear Pennant Pattern in Technical Analysis

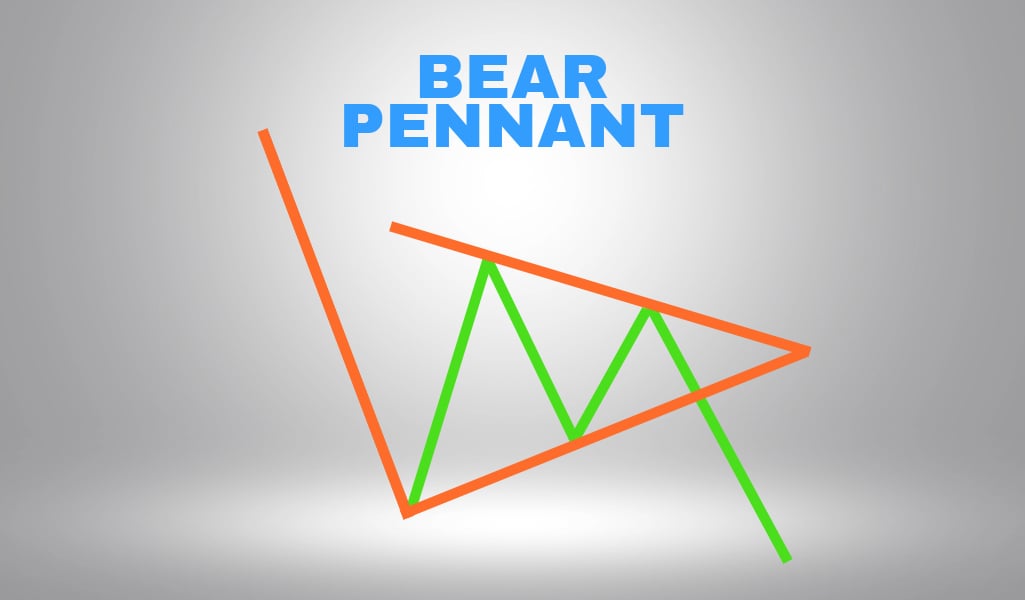

The bear pennant chart pattern represents a period of consolidation. Once the consolidation occurs, there is a strong initial move in prices. This pattern generally happens when prices consolidate after a sharp movement downwards. It forms what resembles a symmetrical triangle. This triangle consists of converging trend lines connecting the lows and the highs during the consolidation period.

Unlike the bullish pennant pattern, which is a manifestation of an upward trend, the bear pennant chart pattern points to a continuation of the current downtrend. To identify a bearish pennant pattern, investors look for a strong initial move downward. You can spot this move as a ‘flagpole’, followed by a consolidation phase where prices oscillate between the support and resistance level . The lines converge, creating the pennant shape.

In a trading setup, traders often place a stop loss just above the upper trend line of the pennant. They enter the market when the price action breaks below the lower trend line, indicating that the bearish momentum is likely to continue. The bear pennant chart pattern thus serves as a reliable indicator for traders to anticipate further downward movement in prices.

What does the Bear Pennant indicate? How to spot a bear pennant?

The bear pennant pattern occurs in two phases. First, there is a downtrend along with a consolidation interval. The consolidation phase begins when traders hit the price action down to form a series of lower lows and higher highs.

During the second phase, the sellers relent once they create a short-term low. This temporary setback comprises the triangular consolidation. The price action goes between the convergences. Similarly to the bear flag, this phase has to derive from a downtrend. Otherwise, it is only a regular triangle.

The phase of consolidation in price ends when the sellers ensure the breakout. It should take place since the lower and upper trend lines converge. This is different from the bear flag since the consolidation phase lasts longer, and the two trend lines are parallel.

The main elements of the bear pennant chart pattern are the flagpole, pennant and breakout. Flagpole indicates that the price is traded in a series of lower lows and higher highs.

The pennant indicates the consolidation in price that happens between two converging lines. Once the lower trend line breaks, the pattern is activated, and the upper trend line’s break invalidates the formation. The sellers benefit from the temporary break and consolidate their profits, preparing for the next price push downwards.

The consolidation phase doesn’t go over 50% Fibonacci retracement of the flagpole. A pullback beyond that goes below 50% indicates a very strong downtrend. Therefore, a sound bear pennant pattern redresses to about 32% prior to the lower trend line break.

Bear Pennant Pattern Strengths and Limitations

Bear pennant is a continuation pattern. It is prone to entice the prolongation of the current downtrend. Therefore, the biggest advantage of a bear pennant is the identification of the phase where the trend is currently happening. Thanks to the pennant and flagpole, this pattern provides traders with precise insight into defined trading levels.

When it comes to weaknesses, they are the same as with the flags. Continued consolidation may result in a reversal. That’s why it is crucial to avoid entering the trade if there is no breakout yet. And you should also pay attention to other indicators to confirm this breakout.

Bear Pennant vs Symmetrical Triangle

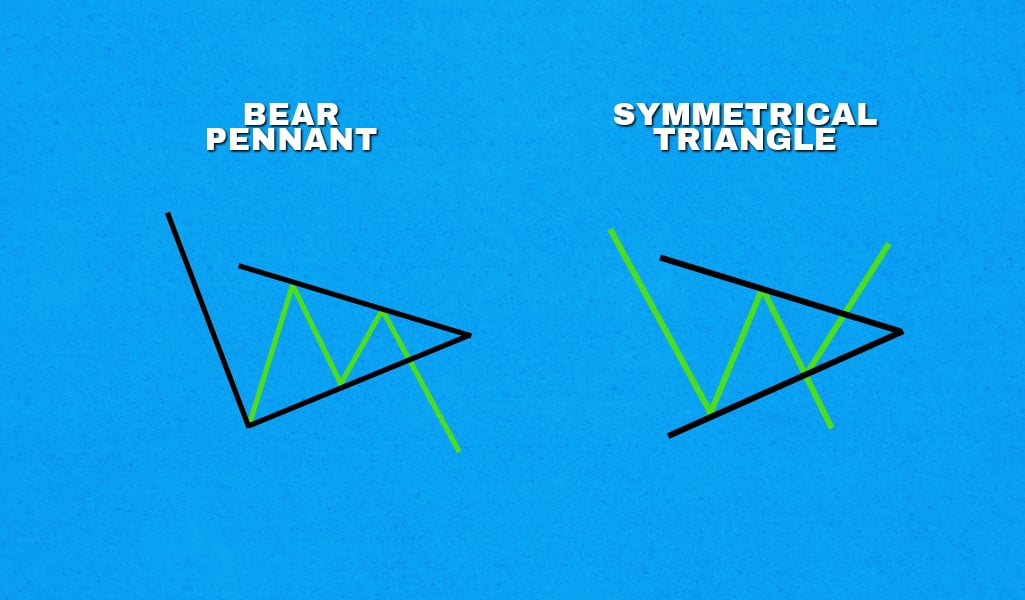

Pennants represent continuation chart patterns, and you can spot a point of breakout after a consolidation period. On the other hand, symmetrical triangles are patterns with two converging trend lines. These lines connect sequential troughs and peaks.

Also, the two main differences between pennants and symmetrical triangles are the flagpole and the duration of each pattern. They both have conical bodies occurring during consolidation. However, you can spot flagpoles at the beginning of the pennant.

The flagpole represents a crucial part of a pennant. It is created once the price spikes or drops significantly in the currency trend’s direction, creating a nearly vertical line. You will also spot the high volume, which determines the start of a dramatic move within the existing trend. The price movement stops creating the pennant’s body and then breaks out in the direction of the trend with renewed strength.

Regarding duration, pennants are short term patterns, while triangles can form over the course of months or even years.

Bear Pennant vs Bear Flag

They seem similar, but there is quite a difference when you draw them in a chart. A bear pennant is created when an asset price consolidates between two convergences and forms a triangular flag that moderately slopes upwards.

A bear flag pattern consists of two horizontal upsloping lines, creating a rectangle-like flag. Finally, pennant and bearish flags take place in a downtrend. Also, they share similarities when it comes to profit targets and breakout direction.

Bear vs Bull Pennant

Both are continuation patterns indicating a pause in the existing trend. A bullish pennant forms once the price action starts. Then, it goes sideways before the prevailing trend resumes.

You can spot bullish pennants during a strong uptrend. The bearish pennant occurs during a downtrend. Finally, you can see that the triangle part in these formations slopes up in case of a bearish pattern or looks nearly flat in case of a bullish pennant. The bullish one breaks out to the upside. The bearish pennant breaks out to the downside.

How to trade Bear Pennant Pattern

- Identify the Bear Pennant

First, recognize a bear pennant pattern in the chart. This pattern consists of a large downward price movement (the pole), followed by a consolidation phase where the price moves within a converging, slightly upward-sloping range (the pennant). This pattern often suggests a continuation of the downward trend.

- Wait for a Breakout

Watch for the price to break below the lower trend line of the pennant. This breakout is your signal that the bearish trend may continue. It’s important to ensure the breakout is on significant trading volume to confirm its strength.

- Open a Short Position

Once the breakout is confirmed, initiate a short-sell position. This means you are betting on the price continuing to fall. It’s crucial to act quickly after the breakout to capitalize on the potential downward movement.

- Set a Stop Loss

To manage risk, place a stop loss order just above the pennant’s highest point or the upper trend line. This stop loss limits potential losses if the price unexpectedly reverses and moves upwards.

- Determine to Take Profit Levels

Set take profit levels based on previous support levels or by measuring the pole’s height and projecting that distance downward from the point of breakout. This method helps in estimating the potential downward movement.

Indicators to Confirm a Bear Pennant

Here is a combination of indicators to help you confirm the pattern predictions.

Volume

A vital indicator for confirming a Bear Pennant. Typically, volume spikes during the formation of the initial flagpole. And it decreases as the pennant forms. Finally, volume increases again when the price breaks below the pennant, confirming the pattern.

Shape and Location

The shape of the pattern must consist of a triangle at the end of a stick. The triangle part appears in the lower part of the stick. Or, more precisely, it appears at the lower third part of the stick. The triangle phase is brief since the market gets ready for unloading a significant correction.

There is no range expansion.

When an asset is in a swift trend, volatility is higher. You can determine the volatility level as a function of low and high during the specific price period. It’s called a range. If the range extends, it shows that volatility goes up and the asset price tends in a specific direction. Once this range falls, we have a consolidation phase. To evaluate if there is a range expansion or contraction, use the ATR average true range indicator. It is the indicator with a one-period setting.

Bottom line: How to Trade the Bear Pennant Pattern

A bearish pennant indicates a dramatic drop in asset price. It’s generally used to spot existing bearish trends in a market. It can alert you of deep and long corrections in the market.

Finally, you need to be aware of the potential risks of false breakouts, as well as the bearish pennant reversal probability.

The post Bear Pennant : How to Trade the Bear Pennant Pattern appeared first on FinanceBrokerage.