Three Bar Play Trading Pattern: How to trade it?

If you are a financial markets trader and want to master technical analysis grasping the three par play pattern is essential. In this article we got you covered regarding all you need to know about this technical indicator.

Three Bar Play Pattern – Key Takeaways

- Three bar play pattern is a simple yet effective day trading strategy that can signal both continuation patterns and trend reversals.

- This pattern consists of three bars: an unusually long candle body, known as the trigger bar, followed by a rest bar, and then an average-sized bar that confirms the pattern.

- Traders often look for this setup near support and resistance levels, as it can indicate a strong move away from these key areas.

- This pattern works well with long term trends but requires confirmation from additional bars

The three-bar play pattern – explained

To trade the three-bar play pattern, you first identify the trend using a moving average. If the trend is bullish, you wait for a long candle that moves in the trend’s direction, followed by a smaller rest bar.

The third bar should break the high of the first, signaling a continuation or reversal. You then enter the trade and set a profit target based on previous price swings or other technical indicators.

For stop loss, you place it just below the low of the rest bar to manage risk on short term trades. This pattern works well with long term trends but requires confirmation from additional bars or indicators to ensure a higher success rate.

Whether in a bullish or bearish trend, the three-bar play pattern can provide clear entry and exit points for traders looking to capitalize on short-term price movements.

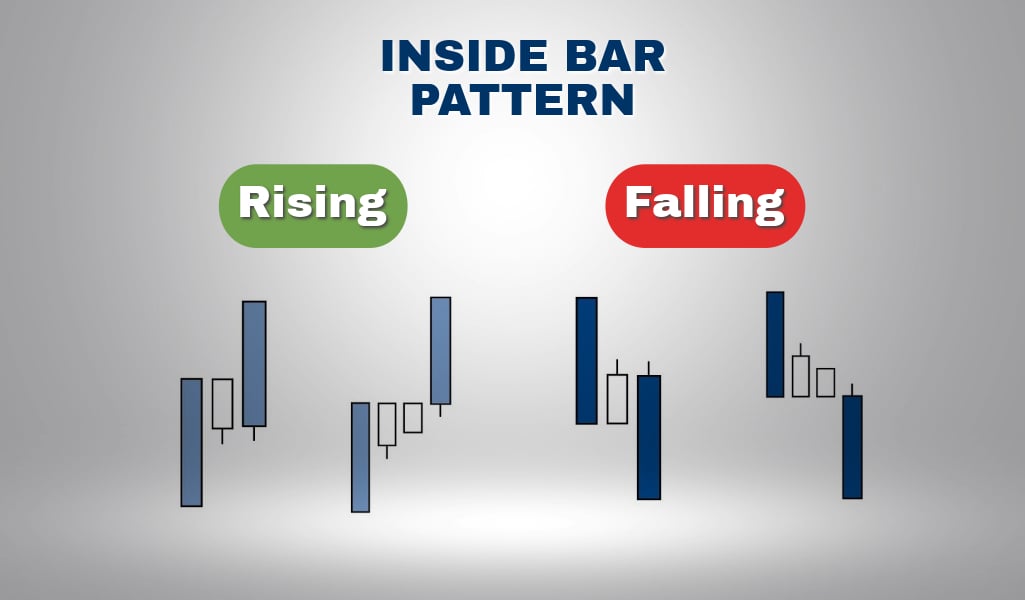

Rising Three Bullish Bar Play Pattern

The bullish version of the three-bar play pattern is a signal indicating a good time to buy. It usually occurs after a period of declining prices or during an ongoing period of rising prices.

In our example, the rising three-bar play pattern appears after a downward trend and consists of three candlesticks that indicate it’s a good time to enter a long position.

To enter the position, you should buy at the opening price of the third candle, as long as it is higher than the closing price of the second candle. To limit your losses, set a stop loss at the lowest point of the first candlestick. For your profit target, aim for the highest point reached during the previous downward trend.

Falling Three Bearish Bar Play Pattern

The falling bar play works the same way as the previous pattern. Their structure is naturally different. You will have to search for a long bearish trend with a small bull candle and the 3rd candle should fall below the second candlestick.

Trading strategy with the three-bar reversal pattern

The three-bar reversal pattern involves three candlesticks. It signals a price reversal. Traders see it as a potent tool. It needs three formations for signal confirmation.

Alton Hill values this pattern for day trading. He notes, volatility can disrupt intraday trades. Hill prefers a specific three-bar setup. The third bar should close above the first two. This approach reduces false signals, aiding trader success.

Hill’s diagram shows two three-bar patterns. The normal one signals bearish or bullish reversals. Hill’s trading pattern demands a higher third bar close. It handles intraday volatility better. Traders thus see fewer false signals.

For a long setup, observe these rules:

- Bar 1 must drop in value, closing down in red.

- Bar 2 should dip lower than Bar 1’s and Bar 3’s lows.

- Bar 3 must rise in value, closing above Bars 1 and 2. Buy at Bar 3’s closing.

For a short setup, consider these:

- Bar 1 should rise in value, closing up in green.

- Bar 2’s peak must exceed Bar 1’s, possibly Bar 3’s.

- Bar 3 should fall in value, closing below Bars 1 and 2. Sell at Bar 3’s closing.

How to trade 3 bar reversal pattern

Using only the three-bar pattern may be imprecise. The pattern alone doesn’t always ensure accuracy. Enhance it with three additional steps.

First, determine the ongoing price structure. This can show trends or sideways movements. Trends have clear directional moves. Sideways markets fluctuate within a range. Trade entries should align with the current trend.

Next, identify key levels. These serve as entry zones. They improve success chances over standalone patterns. Possible key levels include support, resistance, and Fibonacci points.

Oscillators like the RSI also indicate key levels. In downtrends, mark resistance levels for selling. In uptrends, mark support levels for buying.

Finally, all you have to do is wait for the price to enter the levels you marked and form a three-bar reversal pattern. A sell or buy position is taken if the price exhibits a valid three-bar reversal pattern.

Price undergoes a pullback and tests the support level. During the test, the price is rejected and forms a valid three-bar reversal pattern, therefore the buy position is confirmed. The stop loss should be placed below the last low point, while the take profit could be positioned above the last high point.

Trading three bar play pattern tips

It is important to note that if the center bar of the three-bar reversal pattern is an outside bar, traders should exercise increased caution. An outside bar is a bar that has a higher high and a lower low compared to the previous and following bars. This type of bar is often seen as a sign of increased volatility and unpredictability in price action, so traders should be aware of the potential risks of trading this setup.

Three bar play pattern Pros and Cons

Three bar play candlestick pattern pros

Simple to Identify: Beginners can easily learn to spot the three-bar play, thanks to its straightforward pattern.

Clear Entry and Exit Points: The pattern offers decisive signals for when to enter and exit trades.

Versatility: Traders can apply it across different time frames and markets such as stocks, forex, and futures.

Confirmation: The requirement for three bars to form filters some false positives, acting as a built-in confirmation.

Risk Management: Traders can set clear stop-loss levels, often below the low of the second bar in a bullish pattern or above the high of the second bar in a bearish pattern.

Momentum Indicator: The third bar’s sharp move in the new trend direction often indicates strong momentum.

3 bar play pattern Cons

False Signals: The three-bar play can sometimes mislead, especially in volatile or choppy markets.

Requires Confirmation: Prudent traders often seek additional indicators to align, which might lead to missing early opportunities.

Over-reliance Risk: There’s a risk of traders ignoring other market signals by relying too much on the pattern.

Context-Dependent: The pattern’s effectiveness can heavily rely on market conditions and the current trend.

Timing: Traders may miss the optimal risk-reward opportunity if they don’t time their entry accurately after the pattern completes.

Stop-Loss Challenges: Sometimes, the stop-loss levels can be too tight, leading to premature exits before a trend fully develops.

In summary, while the three-bar play serves as a useful tool in trading, combining it with other forms of analysis and awareness of its limits is crucial. Practice and integration into a well-rounded trading strategy with sound risk management is essential for its effective use.

Three bar play pattern – In Conclusion

The three-bar play pattern emerges as a robust day trading approach that adeptly signals potential trend continuations or reversals.

With its structured framework of an unusually long trigger bar, a rest bar, and a confirming average-sized bar, this pattern thrives near critical support and resistance levels.

Traders capitalize on the pattern’s clarity by employing moving averages to discern the trend’s direction, executing trades on a bullish or bearish breakout above or below the trigger bar, and setting precise profit targets and stop losses.

When applying the three-bar play, it’s crucial to align trades with the prevailing trend for optimum effectiveness.

By placing a stop loss beneath the rest bar and targeting profits at logical resistance or support levels, traders can manage risk while aiming for favorable returns on short-term trades.

The pattern’s versatility allows it to function in harmony with long-term trends, although confirmation from additional indicators or bars can markedly improve success rates.

Alton Hill’s adaptation of the three-bar reversal pattern, with the critical criterion of the third bar closing above the first two, further refines this strategy for day traders, ensuring a higher resilience against the inherent volatility of intraday trading.

In essence, the three-bar play pattern serves as a strategic confluence point for price structure analysis, key level identification, and precise entry signals, solidifying its status as an invaluable asset in a day trader’s arsenal.

Whether seeking to capture quick profits or anticipating a significant trend reversal, the three-bar play pattern offers a structured, measurable, and adaptable method to navigate the complexities of market movements.

FAQs

What is the 3 bar rule in stocks?

The 3 bar reversal pattern is a technical indicator that is used to identify trend reversal signals. The pattern involves 3 consecutive candlesticks, whose movement indicates whether a reversal in the trend is bound to happen or not.

What are the 3 bar criteria?

The first bar needs to be an “igniting” bar — a very wide range candle, ideally on high volume. The pullback bar, or bar 2 (& 3), must not exceed 50% retracement of the 1st bar and have relatively equal highs. The trigger bar (or expansion candle) should also be a nice marubozu candle to new highs or lows.

What are the 3 bar criteria?

The first bar needs to be an “igniting” bar — a very wide range candle, ideally on high volume. The pullback bar, or bar 2 (& 3), must not exceed 50% retracement of the 1st bar and have relatively equal highs. The trigger bar (or expansion candle) should also be a nice marubozu candle to new highs or lows.

What is a 3 bar break?

The three Bar Reversal & Go pattern consists of 3 to 5 bearish candles after a bullish breakout. This chart pattern also gives false signals. The best way to handle losing trades when trading three-bar reversals is to place a stop loss below the last candle of the pattern.

The post Three Bar Play Trading Pattern: How to trade it? appeared first on FinanceBrokerage.