Wyckoff Pattern: A Simple Guide for Every Experience Level

Key Takeaways:

1. The Wyckoff Pattern is a vital tool for traders to spot buying opportunities and anticipate price breakouts.

2. Wyckoff’s principles guide traders in stock selection, timing, and risk management.

3. Wyckoff introduced key rules for assessing market behavior and price movements.

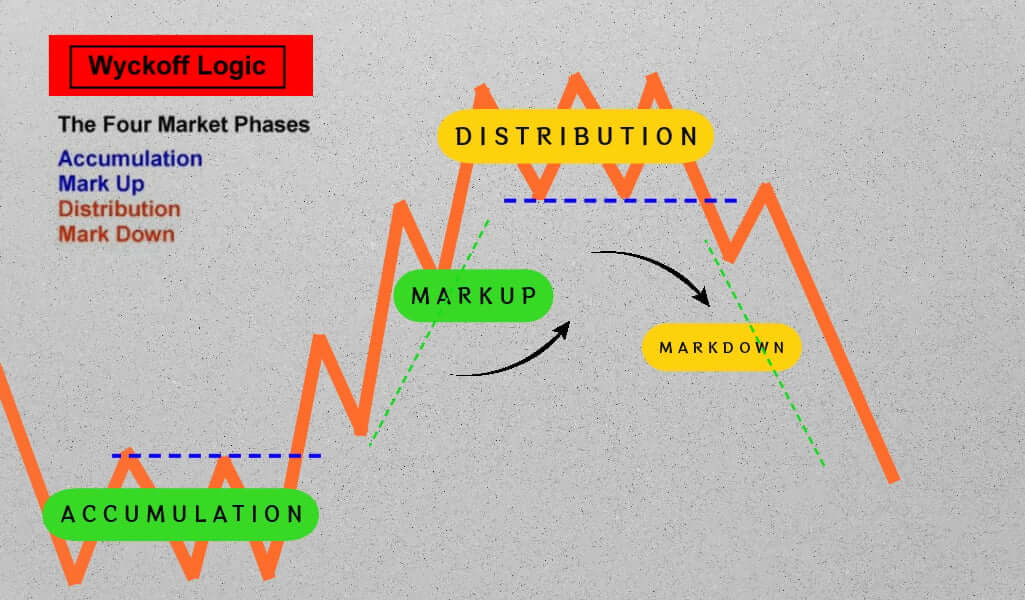

4. The Wyckoff Market Cycle comprises accumulation, markup, distribution, and markdown phases, offering insights into market direction and reversals.

Have you ever thought about what the Wyckoff pattern represents? How come all the professionals are talking about this famous technical analysis lately? And ultimately, why is it crucial in this industry that you know this method most effectively?

In the 1900s, Richard Wyckoff, along with Charles Dow and Jesse Livermore, changed financial market analysis with the Wyckoff Method.

This approach helps traders and investors choose stocks, decide when to buy or sell, and manage risk. It focuses on important ideas like buying and selling phases, Wyckoff springs, Wyckoff tests, and supply and demand principles.

So, what is the Wyckoff pattern exactly? What is this method all about? Let’s get started with the basics of it!

What is the Wyckoff pattern definition?

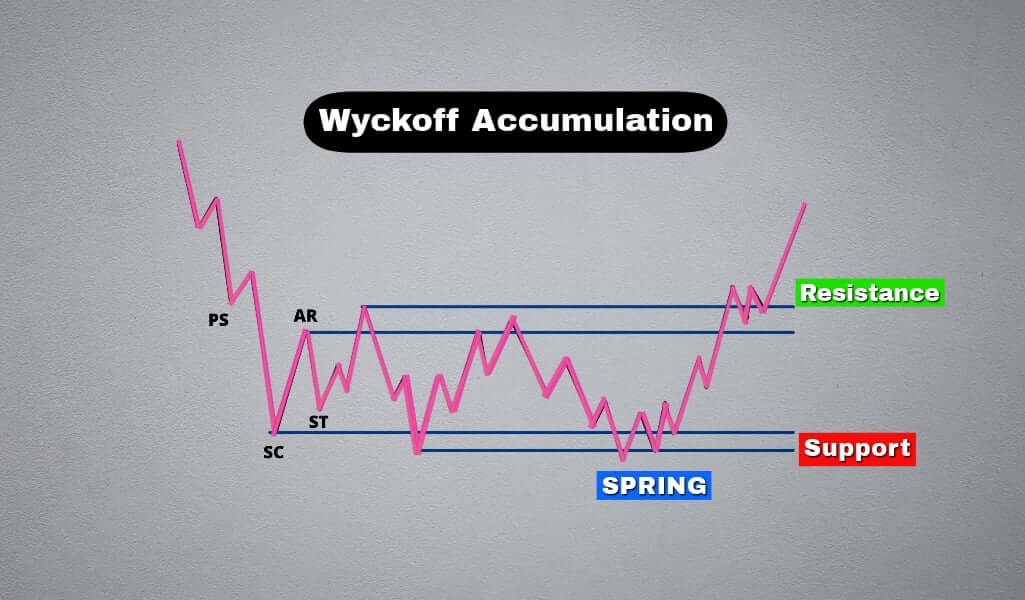

A Wyckoff pattern refers to the Wyckoff accumulation pattern, a chart formation signaling the accumulation phase of an asset.

Recognizing its defining features and elements enables traders to spot potential buying opportunities and forecast price breakouts more effectively.

Get to know what Wyckoff rules are

There are certain Wyckoff rules that you need to know about. The principles of Wyckoff’s market research offer valuable insights. Let’s take a look at two different and valuable rules:

Rule number 1

The market and individual securities rarely repeat the same behavior.

Instead, trends form through various price patterns, each with unique variations in size and movement.

This variety can be seen as a dynamic process that keeps evolving, staying one step ahead of profit-seekers, especially during accumulation phases.

Rule number 2

To understand price movement, compare it to historical price behavior.

To understand today’s price action, you should compare it to past movements. This includes looking at yesterday, last week, last month, or even last year.

A related principle asserts that concluding based solely on the price movement of a single day can lead to inaccurate assessments.

What are the additional rules you need to know about?

Wyckoff introduced straightforward yet potent observational guidelines for identifying trends, trading ranges, and the role of the composite man. He concluded that there existed only three categories of trends: ascending, descending, and stagnant.

Furthermore, he recognized three distinct time intervals: brief, medium-term, and extended. He observed that trends varied greatly over time and within trading ranges, which the composite man often controlled.

Building a Strong Foundation

Wyckoff’s insights paved the way for analysts to craft effective trading strategies and delve into volume analysis by examining how these elements intersect.

Alexander Elder’s Triple Screen Technique

Alexander Elder’s book “Trading for a Living” is a prominent example of these advancements.

Understanding Wyckoff Distribution and Markdown

The distribution phase comes into play when attempts to reach higher highs in the market pricing fail to materialize. In this phase, the price movement is similar to before, but smart investors are making money and being careful.

As a result, weaker participants are forced to sell when the price range drops, starting a markdown phase.

This bearish period generates opportunities for short positions, often evident as throwbacks to new resistance levels.

Markdown Phase and Market Dynamics

Within the markdown phase, the downward slope of the new trend measures the decline. This phase includes stages of redistribution. The market pauses to attract a fresh set of positions that will eventually be sold.

Wyckoff’s terms call steeper rebounds in this phase “corrections,” similar to the language used in the uptrend phase.

The markdown phase ultimately concludes when a broad trading range or base signals the commencement of a new accumulation phase.

Understanding Wyckoff Distribution and Markdown phases is pivotal for effective trading and investing. They provide insights into market support and resistance levels, smart money’s role, and the dynamics surrounding price increases and short positioning.

What is the famous Wyckoff market cycle theory?

The Wyckoff Market Cycle Theory is integral to the Wyckoff method. It explains the dynamics behind the movement of stocks and securities.

Rooted in Wyckoff’s observations of supply and demand, it delineates a cyclical pattern comprising four key phases. This serves as a valuable tool for investors and traders.

The Wyckoff market cycle has four phases: accumulation, markup, distribution, and markdown. It helps predict a stock’s future price based on trader behavior.

In the accumulation phase, institutional investors drive demand, leading to higher lows in the trading range, signalling an impending upward price move.

Understanding Distribution and Wyckoff’s Cycle

During the distribution phase, sellers aim to dominate, leading to lower price tops and a scarcity of higher bottoms within the horizontal trading range.

This phase intensifies during the markdown phase, with prices breaching established range lows. These Wyckoff events mark significant shifts in market dynamics.

Initiating with Accumulation

A new Wyckoff cycle commences with an accumulation phase, recognized by a trading range that often produces a spring, indicating a selling climax.

These events in the markup and markdown phases resemble occurrences near downtrend lows, where prices briefly dip below key support before rebounding.

Progressing into Markup

The markup phase follows, defined by the slope of the new uptrend. Pullbacks to new support levels present buying opportunities, known as “throwbacks” in Wyckoff’s methodology.

Re-accumulation phases and corrective patterns can intermittently interrupt the markup phase, continuing until they fail to generate new highs.

In other words, the Wyckoff Market Cycle provides a framework for comprehending market direction. Furthermore, it can predict reversals and identify accumulation and distribution by examining traders’ actions within these phases and recognizing key Wyckoff events.

Four phases of the Wyckoff Cycle

The Wyckoff Cycle has four phases: accumulation, markup, distribution, and markdown, reflecting trading behaviour and price movements. When the final markdown phase concludes, a new accumulation phase begins, initiating a new cycle.

The Wyckoff Method: Simplifying Stock Selection and Timing

The Wyckoff Method is rooted in Wyckoff’s theories and strategies. It provides a step-by-step approach to stock selection and trade timing. Key principles:

- Assess the current market trend, considering supply and demand dynamics to predict upswings or downturns.

- Choose stocks aligned with the trend, emphasizing strength during upswings and resilience during downturns.

- Opt for stocks under accumulation (or distribution for selling), poised to meet or exceed your price goals.

- Analyze price, volume, and market behaviour to gauge a stock’s readiness for a move.

- Time trades to leverage market reversals: buy on anticipated rallies and sell during expected declines.

Wyckoff Method’s Effectiveness

Wyckoff’s method helps investors analyze markets and time trades. It is popular among institutional investors, traders, and analysts globally in short term.

Applications of the Wyckoff Method

Investors and traders utilize the Wyckoff Method for trend analysis, investment selection, and trade timing, identifying moments of accumulation or distribution. Its straightforward approach promotes emotion-free market entry and exit.

Bottom line

The Wyckoff Pattern is a valuable tool for traders, aiding them in identifying price levels during the accumulation phase of an asset over a specific time frame.

By recognizing its key characteristics, traders can anticipate potential buying opportunities and price breakouts more effectively within a short time frame.

This pattern serves as the core function of Wyckoff’s principles, and analysts widely utilize it in trading to gain insights into market trends and the optimal timing for their trades.

The post Wyckoff Pattern: A Simple Guide for Every Experience Level appeared first on FinanceBrokerage.