What Is a ChoCH in Trading and How to Use It?

In the highly volatile world of Forex trading, successful traders often rely on a concept known as “Change of Character” or ChoCh to gain insights into potential reversals.

First of all, what is a ChoCh?

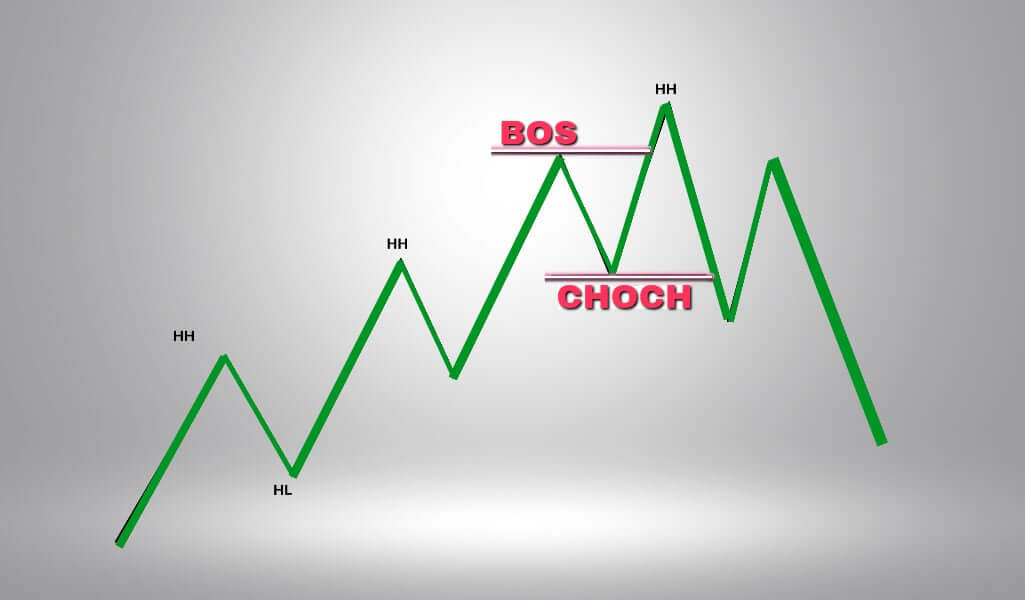

This term represents an initial shift in order flow within a financial market, signifying a structural change in the market dynamics.

When a minor demand or supply zone fails to hold, it can serve as an early indication of a possible shift in the market trend.

ChoCh can be a valuable signal for short-term or even long-term reversal of assets, including equities, currencies, and commodities. It is used by traders in the Forex market as well as in the cryptocurrency market.

How to use ChoCh in trading

As can be seen from the information mentioned above, it isn’t hard to remember an answer to the question “What is a ChoCh?”

The next question is, “How to use ChoCh?”

ChoCh is fractal. That is, it appears on any trading instrument and on any timeframe. As a result, this gives it a wide range of uses.

Its applications can be broadly categorized into two main areas: Higher timeframe ChoCh and lower timeframe ChoCh.

1. Higher timeframe ChoCh

Using ChoCh on higher timeframes involves examining the broader market picture. It helps traders assess the overall market direction and anticipate significant reversals. Recognizing a ChoCh transition on higher timeframes can provide valuable insights into prevailing market sentiment. This information enables traders to align their positions with the evolving market dynamics and make informed decisions regarding long-term trades.

2. Lower timeframe ChoCh

On the contrary, when analyzing lower timeframes, traders utilize ChoCh in order to spot potential trading opportunities.

Analyzing lower timeframes with ChoCh assists traders in spotting short-term shifts in order flow, which can lead to quick and profitable trades.

What should every trader know about the Forex market?

ChoCh plays quite an important role in the Forex market. In order to better understand the role of ChoCh, let’s take a closer look at the Forex market.

The foreign exchange market, often referred to as the Forex market or FX, is the world’s largest financial market. It’s a global marketplace where currencies are bought and sold against one another.

Here are essential things that every trader should know about the Forex market:

Currency pairs:

In Forex trading, currencies are quoted in pairs. The first currency in the pair is called the “base currency,” and the second is the “quote currency.”

The exchange rate tells you how much of the quote currency you need to buy one unit of the base currency. For example, in the EUR/USD pair, EUR is the base currency, and USD is the quote currency.

Market participants:

The Forex market is a decentralized market with a diverse range of participants. These include banks, financial institutions, corporations, governments, speculators, and retail traders. The presence of various players contributes to market liquidity.

Leverage:

Forex trading often involves the use of leverage, allowing traders to control a larger position size with a relatively small amount of capital. While leverage can amplify profits, it also magnifies losses. Risk management is crucial when using leverage.

24-hour market:

The Forex market operates 24 hours a day, five days a week, due to its global nature. It begins in Asia and moves through Europe and North America. This continuous trading cycle provides opportunities for traders in different time zones.

Volatility:

Forex markets can be highly volatile, with exchange rates influenced by various factors like economic data, geopolitical events, central bank policies, and market sentiment. Traders must be prepared for rapid price movements.

Fundamental and technical analysis

Traders use two primary approaches for analyzing the Forex market: fundamental and technical analysis. Fundamental analysis involves evaluating economic indicators, interest rates, and geopolitical events. Technical analysis relies on price charts, patterns, and technical indicators.

Risk management:

Risk management is a cornerstone of successful Forex trading. Traders should define their risk tolerance, set stop-loss orders, and manage position sizes to protect their capital. Never risk more than you can afford to lose.

Broker selection:

Choosing a reputable Forex broker is crucial. Consider factors like regulation, spreads, commissions, trading platforms, and customer support. Ensure the broker aligns with your trading goals and preferences.

Trading psychology:

Emotional discipline is essential in Forex trading. Emotions like fear and greed can lead to impulsive decisions. Successful traders maintain discipline, stick to their trading plans, and avoid overtrading.

Economic calendar:

Stay informed about economic events and announcements that can impact currency markets. Economic calendars provide schedules of important data releases, central bank meetings, and geopolitical events.

Carry trade:

The carry trade strategy involves borrowing funds in a currency with a low interest rate and investing them in a currency with a higher interest rate. Traders profit from the interest rate differential.

Scalping, day trading, and swing trading:

Forex traders employ various trading styles. Scalpers aim for quick, small gains within minutes, while day traders hold positions for a single trading day. Swing traders, on the other hand, aim for larger price swings over several days or weeks.

News trading:

News trading involves capitalizing on market reactions to economic news releases. Traders must be cautious, as the Forex market can exhibit extreme volatility during such events.

Legal and tax considerations:

Forex trading may have tax implications depending on your country of residence. Ensure you understand the tax laws and reporting requirements in your jurisdiction.

Key considerations for using ChoCh

Let’s return to ChoCh.

Although the majority of traders commonly apply the concept of Change of Character (ChoCh) in the Forex market, it’s important to note that ChoCh isn’t restricted exclusively to Forex trading.

This versatile concept can be effectively utilized across a broad spectrum of financial market charts, encompassing stocks, commodities, and cryptocurrencies, among others.

The efficacy of ChoCh is closely tied to the trader’s skill in deciphering and implementing ChoCh signals within the unique context of their selected market. Rather than being confined to particular assets or markets, ChoCh’s effectiveness hinges on a trader’s ability to adapt and apply its principles across diverse trading environments.

This adaptability allows traders to harness the power of ChoCh as a valuable tool for recognizing potential trend reversals and shifts in market sentiment, regardless of the specific financial instruments they are trading.

In conclusion, Change of Character (ChoCh) is a valuable concept in trading that can help traders identify potential trend reversals and significant shifts in market sentiment. It is a versatile tool that can be applied to various trading instruments and timeframes.

The post What is a ChoCH in trading and how to use it? appeared first on FinanceBrokerage.