In the world of stock trading, reverse splits can present unique opportunities, especially for savvy traders looking to capitalize on price movements.

A reverse stock split occurs when a company reduces the number of its outstanding shares, effectively increasing the share price proportionally. While often perceived as a last-ditch effort to maintain a listing on exchanges like NASDAQ, reverse splits can lead to significant profits when approached strategically. This blog will guide you on how to profit from reverse splits, especially focusing on penny stocks.

Understanding Reverse Splits

What is a Reverse Stock Split?

A reverse stock split is a corporate action in which a company consolidates its existing shares into fewer, more valuable shares. For example, in a 1-for-10 reverse split, shareholders will receive one new share for every ten shares they previously held. This action increases the stock price while reducing the overall number of shares outstanding.

Companies typically pursue reverse splits for several reasons:

Maintaining NASDAQ Listing: To remain listed on major exchanges, stocks must meet certain price thresholds. For instance, companies need to maintain a minimum bid price of $1. A reverse split can quickly elevate a stock’s price to meet this requirement.

Attracting Institutional Investors: Higher-priced stocks may appear more attractive to institutional investors who often have restrictions against buying lower-priced stocks.

The Penny Stock Strategy

Why Penny Stocks Use Reverse Splits

Penny stocks, which are often associated with high volatility and risk, frequently utilize reverse splits as a means of raising capital. These companies are typically trying to maintain investor interest while increasing their share price to attract institutional funding.

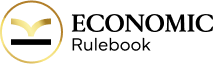

For instance, consider Faraday Future Intelligent Electric Inc. ($FFIE), which executed a 1-for-40 reverse split. Following the split, the stock price jumped from $3.25 to $8.75, showcasing the potential for significant profit following such corporate actions. With a float below 10 million shares, $FFIE became an appealing option for traders looking to capitalize on price movements.

Reverse Split Chart Example

How to Profit from a Reverse Stock Split

Identifying Potential Low Float Runners

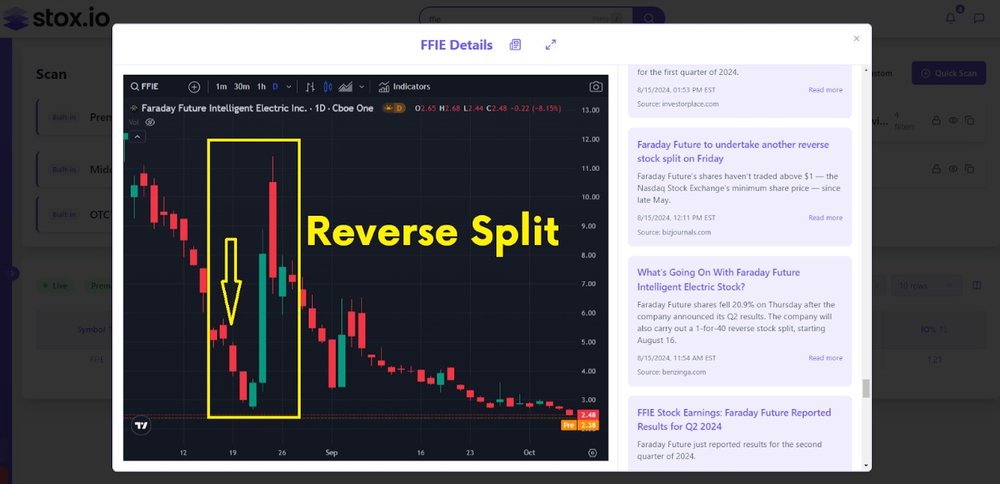

Finding low float stocks that have recently undergone a reverse split is key to unlocking potential profits. Low float stocks, with fewer shares available for trading, can experience dramatic price movements. To streamline your search for these stocks, consider using Stox.io, a beginner-friendly stock scanner that focuses on simplicity, accuracy, and fast refresh rates. Stox.io offers a built-in small-cap gapper scan and provides the most accurate float data, making it an excellent tool for tracking reverse splits and finding potential trading opportunities.

Stox.io Scanner

Is It Better to Sell Before or After a Reverse Split?

Deciding whether to sell before or after a reverse split depends on several factors, including market sentiment and the company’s fundamentals. While selling before a split may seem prudent, particularly if you anticipate a drop in price, selling after can yield greater profits if the stock appreciates post-split.

It’s essential to analyze historical data and observe how similar stocks have reacted to past reverse splits. Many stocks may experience a temporary spike post-split as traders rush to capitalize on perceived opportunities. However, some may also drop significantly as the initial excitement fades. Conducting thorough research and having a clear trading plan can guide your decision.

What Happens to My Money in a Reverse Stock Split?

During a reverse stock split, your investment does not necessarily lose value, but its representation changes. For instance, if you owned 100 shares of a company at $2 per share, following a 1-for-10 reverse split, you would now own 10 shares at $20 each. Although the number of shares you hold decreases, the overall value of your investment should theoretically remain the same immediately after the split.

However, be cautious of potential dilution or losses if the company struggles post-split. Understanding the company’s financial health and market position is crucial to safeguarding your investment during such transitions.

Is a Reverse Stock Split Good for Options?

Reverse splits can complicate options trading. When a reverse split occurs, the strike prices and the number of shares under option contracts are adjusted accordingly. This adjustment can lead to either increased volatility or a misalignment with market expectations.

Traders should consider the implications of reverse splits on their options positions, as they can affect liquidity and pricing. A well-researched strategy involving careful analysis of the stock and its options can yield profitable trades in the wake of a reverse split.

What Does a 1 for 100 Reverse Stock Split Mean?

A 1-for-100 reverse stock split means that for every 100 shares a shareholder owns, they will receive one new share. This type of split dramatically increases the share price while reducing the number of outstanding shares. For example, if a stock was priced at $0.50 before the split, it would be approximately $50 after.

Such significant adjustments in share price can attract traders looking for quick profits, but it also carries risks. The lower float following the split can lead to greater price volatility, which traders need to navigate carefully.

Trading Strategies for Reverse Split Stocks

Longing the Dip: A Reliable Strategy

Timing is crucial when trading reverse split stocks. A common strategy involves longing the dip, particularly during premarket trading. When you receive news of a reverse split, monitor price levels and volume carefully. Stocks with high trading volume premarket often see significant price movement.

As you enter a trade, consider setting stop-loss orders to mitigate risks. Having clear support and resistance levels will also help you manage your position effectively. Remember, just because a stock has undergone a reverse split does not guarantee it will surge; careful analysis and risk management are vital.

Recognizing Market Sentiment

Understanding market sentiment is crucial when trading reverse split stocks. If there is positive news or investor excitement surrounding the company, the stock may experience a rally. Conversely, negative news can lead to rapid declines.

Traders should always stay informed about developments related to the company, including earnings reports, product launches, and management changes. This knowledge can help inform your trading decisions and improve your chances of profiting from reverse splits.

Conclusion

Profiting from reverse splits can be a lucrative endeavor when approached strategically. By understanding the mechanics behind reverse splits, identifying potential low float stocks, and employing effective trading strategies, you can enhance your trading success. Remember, thorough research and staying informed about market trends are key to navigating the often volatile world of penny stocks and reverse splits.

Don’t feel like reading? Watch the video.

Permalink