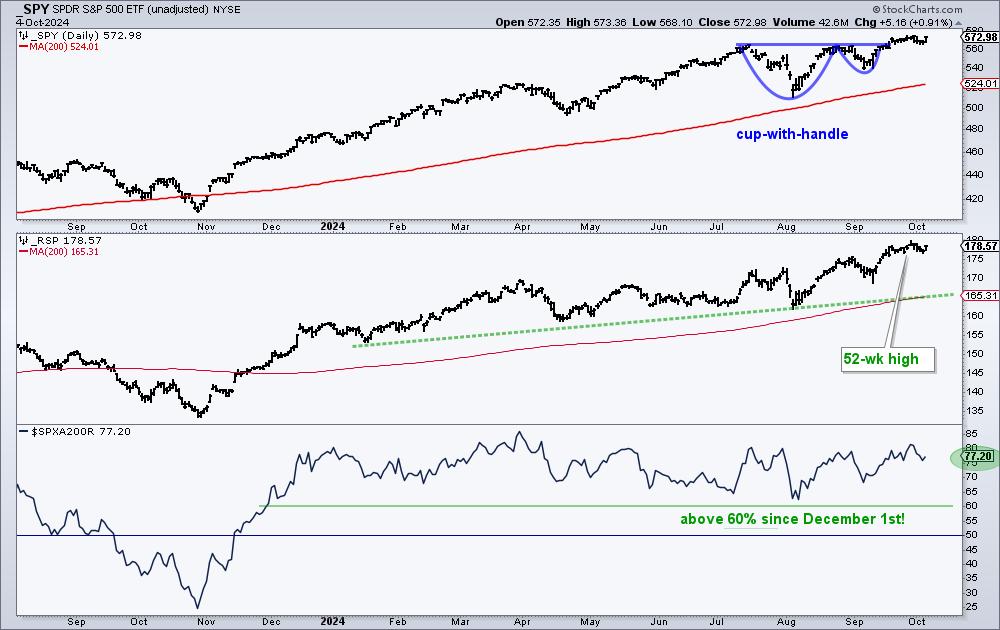

It is a bull market for stocks. On the chart below, the S&P 500 SPDR (SPY) recently broke rim resistance of a cup-with-handle pattern and is trading near a 52-week high. The S&P 500 EW ETF (RSP) recorded a new high in late September and is leading the market since July as the bull market broadened. Moreover, over 75% of S&P 500 stocks are trading above their 200-day SMAs.

And that’s not all. As noted in our weekly reports/videos, QQQ and the Mag7 ETF (MAGS) broke out of triangle consolidations. We can also add narrow yield spreads, a dovish Fed and the Chinese bazooka to the equation. Which brings me to the question: What more do bulls want? Answer: Nothing. October is here and an election looms so we may see above average volatility. Even so, the weight of the evidence is clearly bullish for stocks. Volatility is the price of admission.

In our weekly report/video, we highlighted our top three AI stocks. Two of these broke out in late September and one remains within a bullish continuation pattern. The chart below shows Broadcom (AVGO) hitting a new high in June and trading well above the rising 200-day SMA (red line). After hitting a new high, the stock consolidated with a triangle into September. This is a consolidation within an uptrend, which makes it a bullish continuation pattern. AVGO broke out in late September and this breakout signals a continuation of the long-term uptrend.

Check out TrendInvestorPro to see the other two AI stocks, read our weekly report and get access to two invaluable reports with videos. One shows how to find bullish setups with high reward potential and low risk. The other shows how to use breadth indicators to identify capitulation, thrust signals, oversold conditions and market regime. These reports alone are worth the price of admission.

/////////////////////////////////////////////////