Dogecoin and Shiba Inu are falling to new weekly lows

- On Saturday, the price of Dogecoin rose to 0.13210, a new two-month high

- Last week’s bullish run of the Shiba Inu price was stopped on Friday at the 0.00002169 level

Dogecoin chart analysis

On Saturday, the price of Dogecoin rose to 0.13210, a new two-month high. Shortly after that, we saw the initiation of a bearish consolidation and a drop on Sunday below 0.12400 and the EMA 50 moving average. Monday brought more pressure on the price, which continued to fall towards the 0.11600 support level. For now, Dogecoin has managed to stop further pullback and return above the 0.11800 level.

New support in this zone in the EMA 200 moving average could stop further declines and trigger a bullish consolidation. A move above 0.12000 would see Dogecoin take the first step towards starting a new recovery. Potential higher targets are 0.12200 and 0.12400 levels. The inability to return to the bullish side will continue to push the price to a new daily low. With that step, we strengthen the bearish momentum and expect to see further pullback. Potential lower targets are 0.11400 and 0.11200 levels.

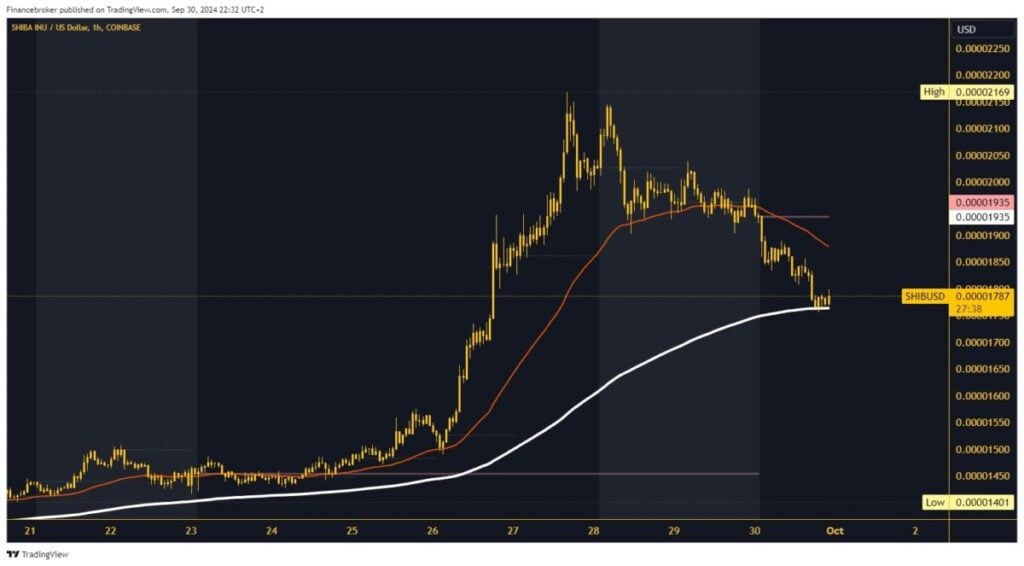

Shiba Inu chart analysis

Last week’s bullish run of the Shiba Inu price was stopped on Friday at the 0.00002169 level. Over the weekend, the price retreated and fell below the 0.00002000 level. On Monday, the pullback below the EMA 50 moving average continued. This caused the price to fall to 0.00001750 and look for support in the EMA 200 moving average. For now, we have the moving average’s support and hope to stay above it.

If we succeed in this, the chance for Shiba Inu to start a new bullish consolidation will increase. Potential higher targets are 0.00001850 and 0.00001900 levels. For a bearish option, we need a negative consolidation and a price drop below the EMA 200 moving average. A break below will reinforce the bearish trap and put pressure on the price. Potential lower targets are 0.00001700 and 0.00001650 levels.

The post Dogecoin and Shiba Inu are falling to new weekly lows appeared first on FinanceBrokerage.