LVMH Stock: Performance, Key Brands, and Future Prospects

LVMH Stock (Moet Hennessy Louis Vuitton SE) is the world’s largest luxury conglomerate and a key member of the European Super Seven group. Jim Cramer, the host of Mad Money on CNBC, referred to LVMH as “exciting for many people.” Moreover, Cramer mentioned some of its top brands, including Louis Vuitton, Bulgari, Givenchy, Dior, and Fendi, which play a crucial role in the industry of fashion and luxury goods. He emphasised LVMH’s strength in targeting “the rich.”

It is worth noting that the company had a standout quarter in January and has been a strong performer. Cramer believes the stock can continue to excel. However, to answer the question, “Is LVMH a good stock to buy?” he still advises investors to wait for a reasonable pullback before purchasing.

LVMH Stock Price Report: Q1 Expert Analysis

In the first half of 2024, the LVMH share price showed a strong performance, with €41.7 billion in revenues, marking a 2% year-on-year organic increase. This led to a profit from recurring operations of €10.7 billion, down 8% compared to the first half of 2023. The results included a 5% negative currency impact. The operating margin hit 25.6%, well above pre-COVID levels. Besides, free cash flow surged by 74% to a more typical level of €3 billion. The gearing remained consistent with usual levels at 18%.

Furthermore, in Q1, nationality-based trends saw slight shifts. US and European customers showed marginal improvement. Meanwhile, the Chinese customer market also remained quite strong. Overall, the resulting changes were minimal. Adjusting the price mix to address excess savings depletion and price increases, US aspirational customers faced pressure due to inflation and higher interest rates, affecting their purchasing power. This situation impacted the US market more significantly than Europe, with some brands feeling the strain. Though Europe itself has also perceived the impact of inflation to a lesser extent, the LVMH stock remains in high demand.

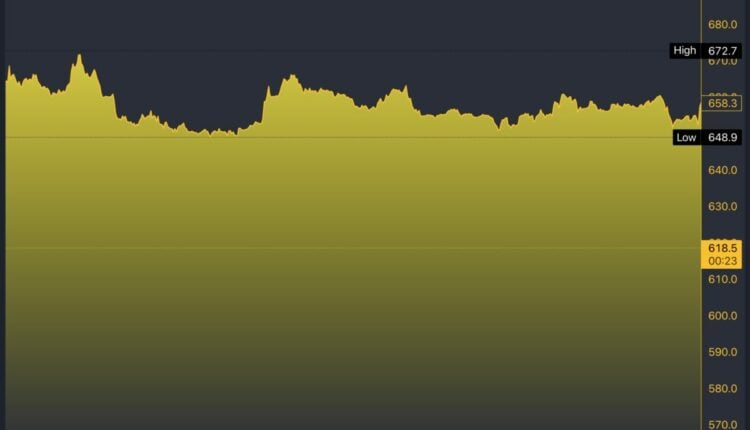

MC/EUR 5-Day Chart

Possible SpaceX Collaboration: Arnault’s Commentary

The Olympics usually symbolize the spirit of competition. However, ideally, they also represent mutual respect among nations. This principle might also apply to luxury conglomerates. Bernard Arnault, CEO of LVMH Moët Hennessy Louis Vuitton, a premium partner for the Summer Games in Paris, focused on mutual respect in his discussion with CNBC’s Andrew Ross Sorkin before the Opening Ceremony.

Arnault confirmed the stake by addressing a Bloomberg report about LVMH’s investment in competitor Compagnie Financière Richemont. However, he downplayed any intentions of a major acquisition. He expressed his positive relationship with Richemont’s owner, Johann Rupert. Besides, Arnault emphasised that the minor investment was just a portfolio decision and not a step toward a takeover. Amidst these developments, the LVMH stock price remains a point of interest for investors. Arnault acknowledged Richemont’s achievements with brands like Cartier and Van Cleef & Arpels, expressing support for its independence.

Despite expanding his luxury empire by acquiring competitors, such as the $16 billion purchase of Tiffany & Co. in 2021, Arnault acknowledged that acquiring Richemont would be a significant move, especially given its market cap of around 82 billion euros compared to LVMH’s 331 billion euros.

For now, the luxury market’s status quo remains unchanged. Meanwhile, Arnault continues to aim higher. During the interview, he mentioned attending an event with French President Emmanuel Macron alongside his “friend” Elon Musk. For instance, he praised Elon for his innovations with Tesla and SpaceX. They even discussed potential collaborations between their companies, hinting at a possible Louis Vuitton and SpaceX partnership. Such news could potentially affect the LVMH stock price, as investors might see the collaboration as a strategic move to combine luxury with cutting-edge technology, potentially opening new market opportunities and enhancing brand prestige.

While Arnault expressed enthusiasm for brand ventures into space, he humorously admitted his reluctance to join Musk on a rocket trip personally. All while laughing off the idea of space travel for himself and jokingly talking about how to buy LVMH stock from Mars. Maybe those weren’t just jokes, after all?

LVMH Stock Forecast: Positive Analyst Outlook

Polen Capital, an investment management firm, recently shared its second-quarter 2024 investor letter for the “LVMH Growth Strategy.” AI continued to dominate market discussions during this period. Although LVMH traditionally aligns with classic “old-money” brands, it remains open to adopting cutting-edge technology. The company’s partnership with Stanford HAI focuses on human-centred AI to enhance the luxury experience while maintaining rigorous ethical standards.

The strategy posted a -1.63% gross return and a -1.91% net return, compared to the MSCI ACW Index’s 2.87% return. The results are a clear indication of strategic success. Looking ahead, LVMH plans to accelerate its strategy by addressing two key areas. First, the company will enhance audits and controls with suppliers, as current measures are deemed insufficient and offer opportunities for improvement. Additionally, LVMH aims to increase vertical integration by enhancing the weaker brands’ performances.

Recent analysis from 14 Wall Street experts provides a positive outlook for LVMH Moet Hennessy Louis Vuitton’s stock. The average price target is set at €843.08, suggesting a potential upside of 16.34% from its current price of €724.64. Analysts predict a range of outcomes, with the highest target at €930.00 and the lowest at €710.00, reflecting an overall optimistic view of LVMH’s performance in the coming year.

The post LVMH Stock: Performance, Key Brands, and Future Prospects appeared first on FinanceBrokerage.