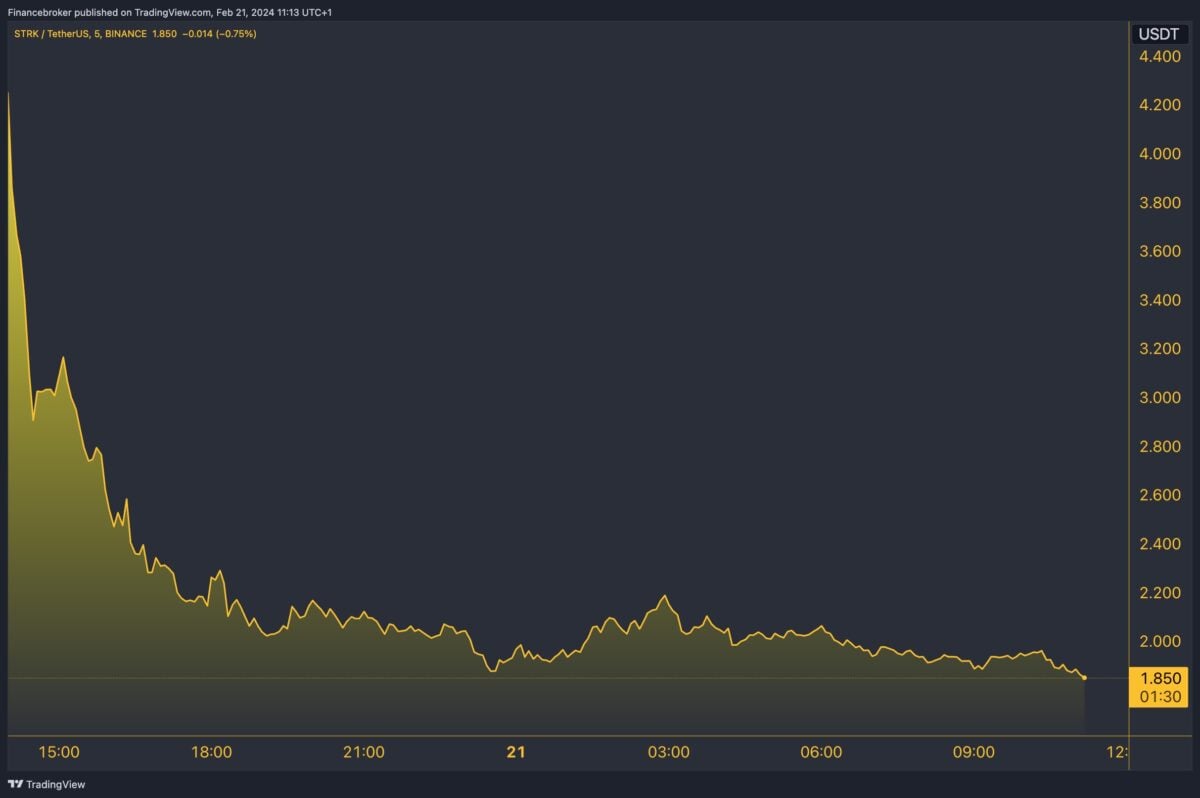

StarkNet (STRK) has recently garnered significant attention due to its dramatic price fluctuations in the rapidly evolving world of cryptocurrencies. Currently, the STRK token is trading at $1.88, starkly contrasting its 24-hour range of $1.87 – $4.41. Let’s delve into the recent price changes of the StarkNet token.

Token’s 24-Hr Shock: $4.41 to $1.88

STRK reached its all-time high of $4.41 on February 20, 2024, only to plummet by 57.5% to its current price. Similarly, its all-time low was recorded at $1.87 on the same day, marking a negligible increase of 0.5%. Despite these fluctuations, the 7-day price change remains stagnant at 0.00%.

Such volatility is not uncommon in the crypto market, especially within a 24-hour window. The market cap of StarkNet stands at $1,371,222,874, ranking it 60th among cryptocurrencies. The stark discrepancy between its total supply (10 billion STRK) and circulating supply (730 million STRK) suggests a vast potential for future market movements.

Crypto Market Up 0.90%: StarkNet Lags Behind

While StarkNet experienced a significant downturn, the global cryptocurrency market saw a slight increase of 0.90% over the last seven days. Ethereum ecosystem cryptocurrencies, similar to StarkNet, witnessed a considerable uptick of 12.70% in the same period, highlighting StarkNet’s underperformance relative to its peers.

In comparison, Bitcoin (BTC) closed its recent session at $52,293, marking a 0.93% increase. This is juxtaposed against the backdrop of declining net inflows for BTC-spot ETFs, reflecting a cautious sentiment among investors. Meanwhile, Ethereum (ETH) closed at $3,014, with a 2.38% rise, entering the overbought territory indicated by a 14-period Daily RSI of 80.11, signalling heightened market activity and investor interest.

StarkNet’s Future: Tech Vs Price Volatility

StarkNet, a Layer 2 scalability solution for Ethereum, aims to enhance transaction efficiency while maintaining security. The recent price drop could be attributed to market corrections or shifts in investor sentiment. However, its fundamental utility in governance, transaction fees, and consensus participation holds promise for long-term value retention and growth.

With StarkNet’s tokens available on major exchanges like Binance, OKX, and KuCoin, it is highly accessible to potential investors. Moreover, the integration with MetaMask allows for easier management and trading, potentially increasing its adoption rate.

The recent price volatility of StarkNet (STRK) presents a complex picture, but it also reflects the broader uncertainties in the cryptocurrency market. While short-term fluctuations are evident, the long-term potential of StarkNet remains grounded in its technological contributions to the Ethereum ecosystem. Investors and enthusiasts should closely monitor market trends, regulatory news, and StarkNet’s developmental progress to make informed decisions. As the market evolves, StarkNet’s role within the larger crypto landscape will undoubtedly be a topic of keen interest and speculation.

The post StarkNet (STRK) Price Plummets 57.5%. Will It Recover Soon? appeared first on FinanceBrokerage.