Coming into 2023, we used the theme, “You can’t hunt with the hounds and run with the rabbit.” Those who stood back with the hounds, in search of a sure hit, were not only left behind, but missed the move higher as the rabbit got the best of them.

This coming year, as we transition into 2024 and into the Year of the Dragon, a new theme emerges. “If you can’t take the heat, don’t tickle the dragon.”

What could that mean? The market could be hot, but lots of circumstances can erupt to tickle the dragon and not necessarily in an amusing way. After all, we know that dragons love to expel fire.

How should you prepare for the coming year? Naturally, as traders, we do not marry any thesis. We watch price.

Click this link to get your free copy of our Market Outlook!

This is for educational purposes only. Trading comes with risk.

If you find it difficult to execute the MarketGauge strategies or would like to explore how we can do it for you, please email Ben Scheibe at Benny@MGAMLLC.com, our Head of Institutional Sales. Cell: 612-518-2482.

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

Traders World Fintech Awards

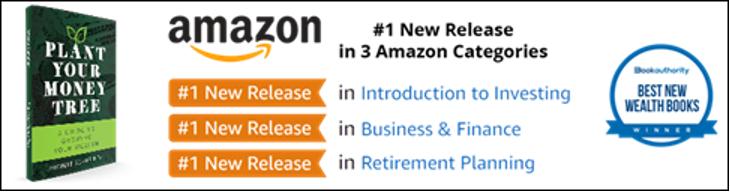

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth.

Grow your wealth today and plant your money tree!

“I grew my money tree and so can you!” – Mish Schneider

“I grew my money tree and so can you!” – Mish Schneider

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Mish makes the case for Vaxcyte (PCVX) and presents the bullish case for gold in this appearance on Business First AM from November 29th.

Mish talksabout money supply, debt, the consumer, inflation and trends that could gain traction in 2024 with Nicole Petallides on Schwab Network.

On the Tuesday, November 28 edition of StockCharts TV’s Your Daily Five, Mish presents 6 stock picks with specific actionable plans.

Mish covers the technical setup for Palo Alto and how MarketGauge’s quant models found this winner on Business First AM.

Mish and Maggie Lake cover inflation, technology, commodities and stock picks in this interview with Real Vision.

Coming Up:

December 21: Spaces with Mario Nawfal

December 22: Yahoo! Finance

December 28: Singapore Breakfast Radio

January 2: The Final Bar with David Keller, StockCharts TV

January 5: Daily Briefing, Real Vision

Weekly: Business First AM, CMC Markets

ETF Summary

- S&P 500 (SPY): 480 all-time highs, 465 underlying support.

- Russell 2000 (IWM): 200 pivotal and 194 support.

- Dow (DIA): Needs to hold 370.

- Nasdaq (QQQ): 410 resistance with support at 395.

- Regional Banks (KRE): 47 support, 55 resistance.

- Semiconductors (SMH): 174 pivotal support to hold this month.

- Transportation (IYT): Needs to hold 250.

- Biotechnology (IBB): 130 pivotal support.

- Retail (XRT): Huge gap up last 2 days of the week that now needs to hold.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education