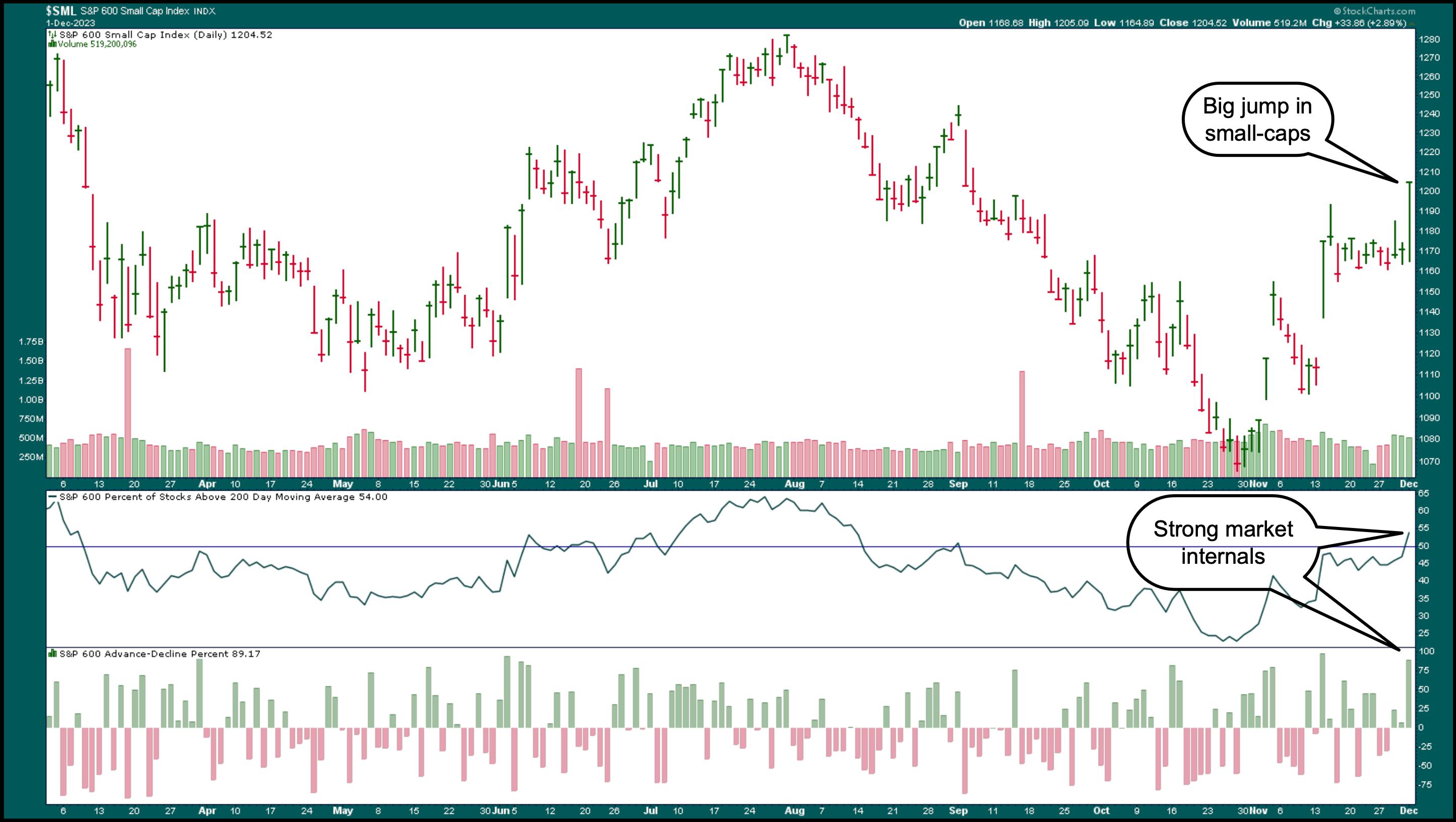

The stock market is off to a great start on the first trading day of December. The S&P 500 ($SPX) closed at its 2023 high, the Dow Jones Industrial Average ($INDU) hit a new 52-week high, and the Nasdaq Composite ($COMPQ) also closed higher. Small caps led the rally, with the S&P 600 Small Cap Index ($SML) up 2.89%. It’s worth noting that small caps are displaying strengthening market internals. The percentage of S&P 600 stocks above their 200-day moving average is over 50%, and the Advance-Decline Line is in positive territory.

CHART 1: SMALL-CAP STOCKS TAKE OFF. It’s typical for small-cap stocks to rally in December. Keep an eye on how this asset group plays out; it could indicate the market’s performance in 2024.Chart source: StockCharts.com. For educational purposes.

November was a terrific month in the stock market, with the broader indexes eking out solid gains. The S&P 500 was up almost 9% for the month, and the Nasdaq Composite closed out November with a 10.7% gain.

Most of the rally in the stock market may have been because the stock market is betting that the Fed will start to cut interest rates. Comments from Fed Chairman Powell on Friday were similar to what he’s said in the past, which put investors more at ease.

Stock Market Seasonality

This type of market behavior isn’t unusual in the stock market at this time of the year. In a recent episode of The Final Bar, our chief market strategist, David Keller, CMT, spoke with Jeff Hirsch, Editor of the Stock Trader’s Almanac, about the seasonal patterns that are typical at the end of the year and in the first few months of an election year. So far, the market is in sync with what the Almanac anticipates. If this continues to be the case, then it’s likely that 2024 will be a bullish stock market year.

When analyzing the stock market, the only certainty is that nothing works the way you expect. So, as a trader or investor, you should be aware that, if things aren’t falling into place like they should, it’s an early indication that something is likely to go wrong.

Early December tends to be flat, mostly because of tax loss selling. The selling can make some investors nervous, especially after a robust November. But December is an important month, since it kicks off some seasonal patterns such as the January Effect and Santa Claus Rally.

The January Effect

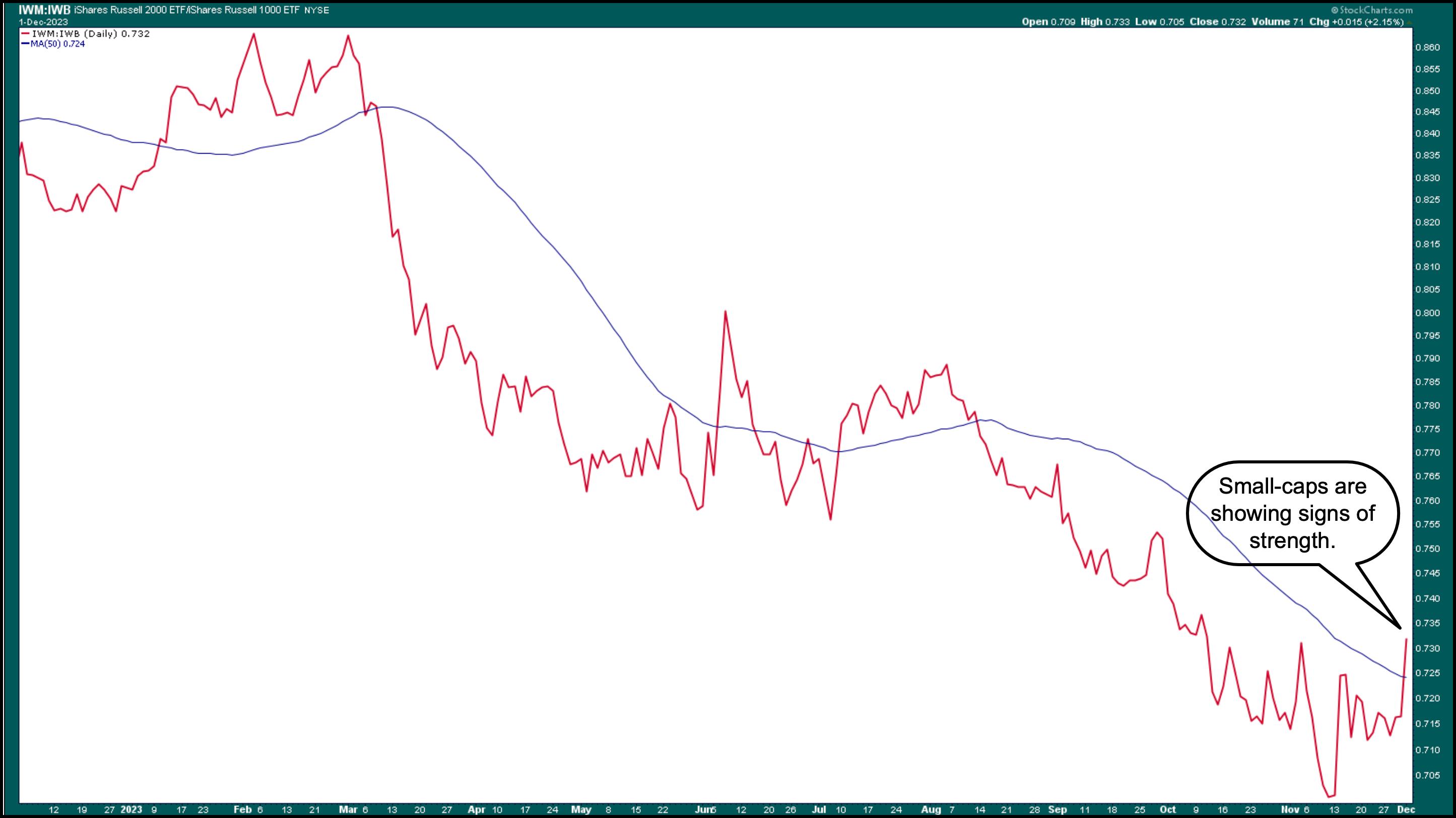

The January Effect, which starts in mid-December, is about small-cap stocks, which didn’t participate in the bull rally that large-cap stocks experienced. But they are showing signs of taking off. The chart below shows the ratio of the iShares Russell 2000 ETF (IWM) to the iShares Russell 1000 ETF (IWB). The rise above the 50-day simple moving average indicates that small caps, represented by IWM, are gaining strength. It’s worth watching the small caps as mid-December approaches.

CHART 2: SMALL CAPS VS. LARGE CAPS. When analyzing the ratio of small caps to large caps, it looks like small caps are starting to show signs of strength.Chart source: StockCharts.com. For educational purposes.

The Santa Claus Rally

The Santa Claus Rally, which takes place on the last five trading days of December and the first two trading days in January, is also critical. If this short rally fails to show up, you should tread with caution in 2024. That doesn’t mean you should sell your stocks. Instead, you may want to rebalance your portfolio so it’s in line with how the market is playing out. For example, if defensive sectors are outperforming other sectors, you may want to allocate more of your portfolio to defensive stocks like Consumer Staples, instead of offensive ones. And depending on how commodities are performing, you may want to allocate more weight to energy or gold stocks.

The January Barometer

Next year is an election year, so the first half of the year will be important. How the year plays out rests on how January performs. The Stock Trader’s Almanac covers various seasonal patterns you can expect in the early months of an election year. In addition, watch fundamentals, especially interest rates. Whether the Fed cuts rates or not will have an impact on the stock market.

The Bottom Line

So, as we approach the last month of the year, watch the small caps, note how the market performs during the last five trading days and first two of 2024, and observe how January plays out. If everything plays out as expected, we’ll have a bullish 2024.

End-of-Week Wrap-Up

US equity indexes up; volatility down

- $SPX up 0.59% at 4594.63, $INDU up 0.82% at 36245.50; $COMPQ up 0.55% at 14305.03

- $VIX down 2.24% at 12.63

- Best performing sector for the week: Real Estate

- Worst performing sector for the week: Communication Services

- Top 5 Large Cap SCTR stocks: Coinbase Global, Inc. (COIN); PDD Holdings, Inc. (PDD); Vertiv Holdings, LLC (VRT); New Oriental Education & Technology Group, Inc. (EDU); Crowdstrike Holdings, Inc. (CRWD)

On the Radar Next Week

- October Factory Orders

- October ISM Services PMI

- October JOLTs Job Openings

- November Non-Farm Payrolls

- November Unemployment Rate

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.