What is a divergence cheat sheet? Examples By an Expert

Key Takeaways:

- Divergence trading spots discrepancies between price and indicators, offering trade opportunities.

- Different types of divergence signal trend shifts.

- A cheat sheet simplifies identification, especially for beginners.

- Stochastic oscillators help identify overbought and oversold conditions for informed trading.

Have you recently thought about what a divergence cheat sheet is? Why is it important to grasp the entire idea of this sheet and enhance your trading skills and long-term outcomes?

Divergence traders spot differences to find price changes, aiming to catch big moves in the market. Identifying divergence signals on trading charts is important. It’s not too difficult, but a cheat sheet can be useful.

This article provides important information about the divergence cheat sheet. It explains various types of divergences, such as RSI divergence, classic Divergence, bullish Divergence, and hidden Divergence.

Before getting to know how to spot them on a price chart, let’s get all the basics, shall we?

Understanding divergence cheat sheet and its meaning

First, it’s crucial to understand the term “Divergence” in trading. All newbies and those unsure of the meaning of this term should know that Divergence trading is a straightforward strategy. In it, traders seek differences between an asset’s price and a technical indicator.

They use this to spot potential weakening trends for a pause or reversal. It relies on the idea that the asset’s price and the indicator should generally move in the same direction. When they diverge, indicating a mismatch, we call it Divergence.

Common indicators include stochastic oscillator, RSI, CCI, and MACD. Traders use this to detect early signals of trend weakness and take positions based on market conditions.

What does trading divergences involve?

Trading divergences, specifically RSI divergence and classic Divergence, involve spotting discrepancies between an asset’s price and a technical indicator.

Divergence traders are able to spot differences to find price changes, aiming to catch big moves in the market.

When executed correctly, this particular approach can lead to profitable trades. Identifying divergence signals on trading charts is important. It’s not too difficult, but a cheat sheet can be useful.

Remember, divergence traders spot differences to find price changes, aiming to catch big moves in the market.

How to best identify Divergence in trading?

Identifying Divergence in trading means spotting differences between price movements and technical indicators. Here’s how:

In an uptrend, prices usually form higher highs and higher lows; in downtrends, they make lower lows and lower highs. Normally, technical indicators like RSI, MACD, CCI, and Stochastic Oscillator align with price direction.

In divergence trading, traders rely on RSI and MACD Divergence to detect discrepancies between indicators and price movements.

This approach allows them to identify potential price shifts and capitalize on significant market movements.

Different types of Divergence – explained.

But when they don’t, you can find trading opportunities. This is actually divergence trading. There are different types of Divergence:

- Bullish Divergence: When the price weakens, indicators suggest a potential upward move.

- Bearish Divergence: When the price seems strong, but indicators indicate a potential downward move.

- Hidden Divergence: Occurs when price and indicators move in opposite directions within an ongoing trend.

To trade Divergence effectively, you must use a divergence cheat sheet and follow specific rules for each type. Remember, confirming divergence signals using techniques like chart patterns and Fibonacci levels is crucial.

Divergence trading uses RSI and MACD to exploit price differences and make smart choices based on momentum. It’s a valuable strategy for identifying potential trend reversals or continuations in the market.

Four types of Divergence cheat sheet

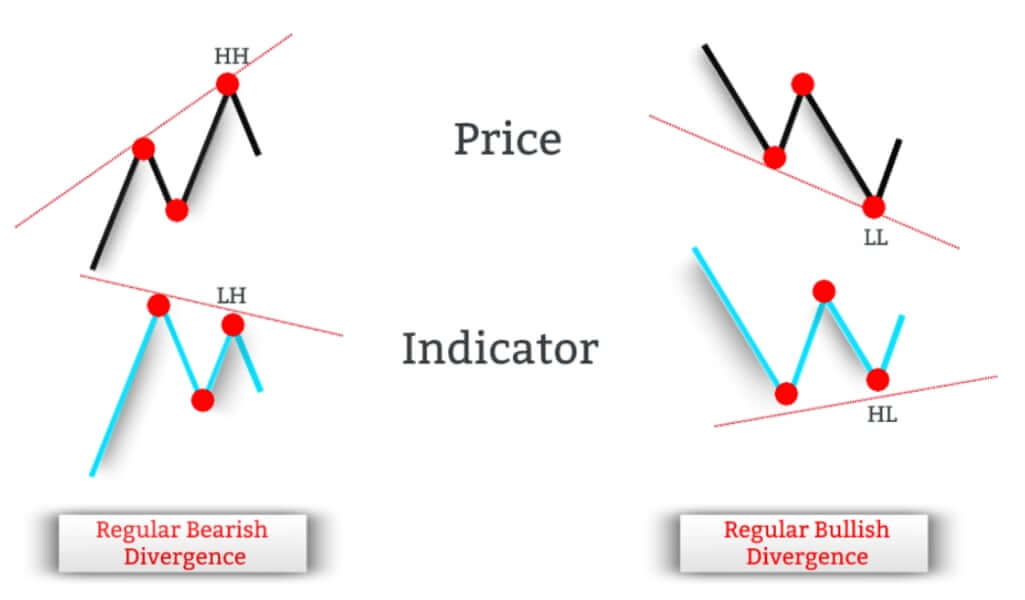

Divergences in trading come in two main flavours: regular and hidden. Each category branches into two forms: bullish and bearish.

The main difference is in the possible results. Hidden differences mean the current trend will probably continue, while regular differences suggest a potential change in the trend.

Here are the four key types:

- Regular Bullish Divergence happens when an asset’s price is going down. However, certain indicators, like the stochastic oscillator, show that it’s not going down as much. Traders see this as a sign that the downtrend is losing steam, potentially leading to price reversal.

- Regular bearish Divergence occurs when an asset’s price goes up, but momentum indicators show a decrease. This suggests a weakening of the uptrend and hints at a possible reversal.

- Hidden bullish Divergence happens when an asset going up has higher lows, but the momentum indicators show lower lows. This is different from normal Divergence. It indicates a brief interruption in the trend. This shows us that the trend will likely continue in the same direction.

- Hidden Bearish Divergence occurs when a declining asset has lower highs, but the momentum indicators show higher highs. Much like hidden bullish Divergence, this suggests a temporary pause in the downtrend before it resumes.

These concepts are vital for traders as they use them to interpret trading signals and make informed decisions. Recognizing bullish and bearish Divergence can help predict trend reversals or trend continuation.

Traders use support and resistance levels, along with momentum indicators, to confirm divergence signals. This applies to trading currency pairs or any asset where prices may reverse or show a price difference.

What is a stochastic oscillator?

A stochastic oscillator is a trading tool. Traders utilize it to analyze a stock’s recent closing price and its price range. Also, they are able to do this analysis over a specific time period.

To make it less sensitive to market changes, you can adjust the time frame or apply a moving average to the results. This indicator helps identify overbought and oversold conditions within 0 to 100.

Key Points:

- Stochastic oscillators are popular for spotting overbought and oversold signals.

- They serve as a well-known momentum indicator introduced in the 1950s.

- These oscillators fluctuate around an average price level, drawing on an asset’s price history.

- They measure price momentum for trend identification and reversal prediction.

In addition, stochastic Divergence and oscillator divergence are essential concepts in trading. These divergence types involve spotting discrepancies between the stochastic oscillator and price movements, helping traders identify potential reversals or continuation points.

It’s a valuable tool for addressing price-action discrepancies and making informed trading decisions.

Bottom line

In summary, Divergence is a useful tool in technical analysis, providing trade signals. It involves understanding specific indicators and comparing them to price movements to identify potential opportunities.

For beginners and advanced traders, remembering divergence types can be time-consuming. To simplify, use a divergence cheat sheet until you become more familiar with spotting divergences naturally.

Explore our learning hub for valuable support, find out more about market trends, technical analysis tools, trend lines and much more from trading analysts!

The post What is a divergence cheat sheet: Examples By an Expert appeared first on FinanceBrokerage.