Cryptocurrency options trading explained

Diving deep into the crypto asset landscape reveals a dynamic world of options contracts. On crypto exchange platforms, price movements intrigue seasoned and novice options traders alike.But can you option trade crypto ? The answer is – yes. With crypto options trading platforms, one can start trading, leveraging trades to maximize potential gains.

Understanding trading strategies, from put options to margin trading, is crucial. These strategies dictate when to buy or sell in the ever-fluctuating price of Bitcoin and other digital assets.

Mastering call-and-put options, traders can precisely sell an asset or hedge against unwanted moves. Stellar customer support, coupled with transparent trading fees, empowers individuals in the expansive options markets. With the right knowledge, risk management becomes a trader’s best friend. Dive in and unlock the potential of cryptocurrency options trading.

What are crypto derivatives?

Generally, options and futures are two categories of derivative agreements that obtain their worth from changes in the market for the fundamental index, security, or commodity.

A derivative agreement for cryptocurrency is a tradable fiscal tool that gains its worth from a fundamental crypto asset, allowing traders to experience the asset’s price fluctuations without actually possessing it.

The best platforms to trade cryptocurrency derivatives

If you were wondering where to trade crypto options, what are the best crypto options trading platforms, here are 4 platforms that we suggest.

Deribit

Deribit is one of the most popular cryptocurrency options trading platforms. The company is located in Panama, and, at first, they were BTC-focused.

Now, they are also offering ETH contracts. They offer a vast variety of trading order types from market limit to trailing stop.

Deribit has a maker-taker fee model. This means that orders providing liquidity could have different fees versus orders that take liquidity. Fees vary per product and are calculated as a percentage of the underlying asset of the contract.

Deribit offers European-style cash-settled options. European-style options on Deribit are automatically exercised only at their expiry and cannot be executed before that point.

Furthermore, with cash settlement, when these options reach their expiry date, the writer of the options contract is responsible for paying any profits owed to the holder, rather than transferring any underlying assets. Meanwhile, the option premium is immediately subtracted from the buyer’s cash balance.

The options are priced in ETH or BTC. However, the relevant price can also be seen in USD. The price in USD is determined by using the latest futures price. Additionally, the implied volatility of the price is also displayed on the platform.

A call option is the right to buy 1 BTC at a specific price (the strike price), and a put option is the right to sell 1 BTC at a specific price (the strike price).

Now you might be wondering where else to trade ethereum options ? Besides Derebit, the main trading venues for ETH options are Bidget and Crypto.com.

The main drawback of Derebit is that the platform is not available in the USA. Deribit is not licensed to operate in the USA and doesn’t allow US users.

Bitget: the platform suitable for beginners

Let’s discuss another cryptocurrency options trading platform. Bitget is suitable for beginner traders but will also delight the most experienced traders, Bitget offers more than 100 cryptocurrencies for futures trading. The platform is today one of the leaders in the sector and has significant liquidity.

For futures trading, each trade on Bitget incurs a transaction fee of 0.02% for Maker orders and 0.06% for Taker orders. However, by using BGB (Bitget’s token) as a margin for futures, users can enjoy a 15% discount on trading fees.

Bitget also offers a copy trading feature that enables you to copy the strategy of the platform’s top users. The selected strategies can be customized according to each user’s preferences.

Crypto.com: a complete ecosystem

A platform well known for its crypto-card and its mobile application, Crypto.com also offers cryptocurrency futures.

On Crypto.com, futures trading fees are proportionally decreasing to the user’s monthly transaction volume, but also depending on the number of CRO tokens placed in staking.

The default fee is 0.05% for maker orders and 0.07% for taker orders. Full details on Crypto.com fees are on this page.

Although more expensive in fees than its competitors, Crypto.com offers a complete ecosystem of solutions for investing in cryptocurrencies. The platform obviously offers a spot market but also a trading bot, CRO token staking, yield farming, and even instant loans covered by cryptocurrencies.

How to Buy and Sell Bitcoin Options

How to trade Bitcoin options ? To trade BTC options, you need to grasp first the basics. Trading options means trading financial derivatives.

Trading the obligations means you have the right but not the obligation to purchase or sell the underlying asset on the determined date in the future. And that is actually its main difference from the futures contracts.

When it comes to trading Bitcoin options, the asset is Bitcoin. You can trade other cryptos, too like ETH, for instance. Cryptocurrency options are less liquid than options on commodities, stocks or indexes. That’s because the crypto market is still a lot smaller than traditional financial markets.

Finally, there is an important difference between the American and European options contracts. The latter can only be exercised at the expiration date, and the American can be exercised any time till the expiration date.

Cryptocurrency options trading – Calls vs. Puts

Traders can either put or buy an option. If you call the option, it means you have the right to purchase the asset. When you put the option, it means that you have the right to sell the underlying asset. Which one you will choose depends on your appetite to speculate on the market or if you just want to hedge your cryptocurrency exposure.

The option contacts can be physical and in cash. Once your contract expires, there is a way that the underlying asset is shipped to you, or you can get cash. But since cryptocurrency doesn’t have its physical form, you can settle BTC options only in cash, or you can settle for BTC futures when the contract expires.

ATM vs. ITM vs. OTM

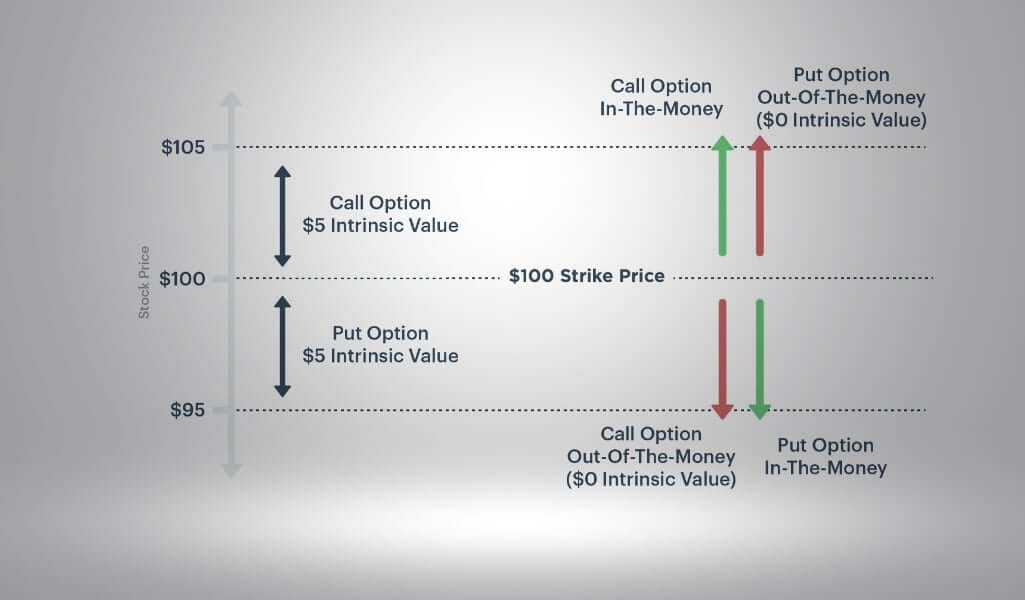

There are three types of options for positions you can open. These are In the money, out of the money and at the money. What do these terms mean? An “in the money” option is a term used in options trading to describe a situation where the option has intrinsic value.

In the context of call options, an option is “in the money” when the current price of the underlying asset is higher than the option’s strike price. For put options, an option is “in the money” when the current market price of the underlying asset is lower than the option’s strike price.

In-the-money options typically have a higher premium (the price you pay for the option) compared to out-of-the-money options, as they have intrinsic value. Traders often seek in-the-money options when they want to execute the option and take advantage of the difference in price between the strike and the current price.

Let’s see an example.

For call options: If you have a call option and its strike price of $50, and the current market price of the asset is $60, the call option is “in the money” by $10 because you have the right to buy the asset for $50 and sell it for $60, making a $10 profit.

For put options: If you have a put option and its strike price is $60. And the current price of the underlying asset is $50. The put option is “in the money” by $10 because you have the right to sell the asset for $60 when it’s only worth $50, resulting in a $10 gain.

The risks of currency options trading

Bitcoin options are exposed to the extreme price volatility of the crypto market, which can result in substantial price swings that may render options worthless or result in significant losses.

Also, the liquidity of Bitcoin options can vary, making it tricky to enter or exit positions at desired prices, which can lead to unfavourable execution.

Options trading involves a level of complexity and requires a deep understanding of financial derivatives. Inexperienced traders can make incorrect predictions, resulting in financial losses.

Finally, option contracts have expiration dates, and as time passes, the value of the option erodes, even if the underlying asset’s price moves in the desired direction. Traders need to manage time decay effectively to avoid losing their entire investment.

The post Cryptocurrency options trading explained appeared first on FinanceBrokerage.